What if The Dividend Haters Are Right?

Post something about dividend investing on social media and… well, things get weird.

Out comes the “total return” crowd.

The folks who think dividends are outdated. Inefficient. Or even irrational.

And they’ll tell you all about it.

They’ll tell you that a smart investor should focus on growth.

And if you want income, you should just sell some shares.

But let’s take a step back - are they right?

Let’s look at the facts, follow the math, and find out!

Taxes

This is the first place the anti-dividend crowd starts - taxes.

Dividends get taxed! Terrible!

They say it like it’s a revelation.

But here’s the thing:

So do capital gains

So does bond interest

So does your paycheck

Everything gets taxed eventually

Funny that none of them tell me they avoid jobs so they don’t have to pay income taxes…

I usually skip taxes in my articles. Everyone’s situation is different.

It depends on where you live, how much you earn, and what type of account you use.

Taxes are part of a bigger financial plan.

But in this example, I’ll keep it simple:

Let’s say you pay 15% tax on dividends, like many U.S. investors do.

I know that won’t apply to everyone, but it’s a starting point.

Dividend Portfolio

If you start a $100k portfolio with:

3% dividend yield

15% dividend tax rate

7% price growth

7% dividend growth

Fast forward 20 years…

You’ve got $623,085 in your account.

And $18,903 in annual dividend income.

Total value: $641,988.

The Growth-Only Portfolio

Same starting point: $100,000.

No dividends.

Just 10% annual price growth.

Still a 10% total return - so they’re equivalent.

After 20 years?

You’re at $672,750.

That’s about $31,000 more. Seems like a win.

But not so fast.

We need to talk about the difference between real returns and theoretical ones.

The scenario I ran looks like the top picture in this graphic, nice and smooth, no down years.

But in the real world and the market looks like the bottom one. And this matters.

Dividends are taxed because you actually received cash. Real dollars. In your account. Spendable.

With capital gains, the IRS can’t tax you yet — because you haven’t received anything. The share price might have gone up, but it’s all just numbers on a screen until you sell.

That means if you're relying entirely on price growth for income, your return is a maybe — not a guarantee.

You don’t have a real, usable return until you hit sell.

And when you do, your outcome depends entirely on timing.

Taxes only decreased the dividend portfolio by 5% - that’s not a big drop for a portfolio.

That growth only portfolio probably looked pretty good in 2021, but if you needed income in 2022, that was a different story.

We’ll talk about this more later, but being a forced seller in a down market isn’t a good place to be when we look at future returns.

Now compare that to the dividend investor.

Over 20 years, they received over $165,000 in real, taxed, spendable cash — and they never had to sell a single share.

They got part of their returns along the way.

The growth only investor deferred all of their returns.

Time reduces the value of a dollar. A dollar today is worth more than a dollar tomorrow.

That $165,000 you waited 20 years to receive?

It’s not worth $165,000 anymore.

You have to discount it — because of time value of money.

So yes — the growth portfolio shows a higher ending balance on paper.

But It should, because you waited two decades to realize any of it.

Dividends might come with an immediate tax, but they offer the immense advantage of providing actual, accessible cash that’s not dependent on the market.

One isn’t necessarily better than the other - but in real and practical terms, they’re not at all the same.

We’ll come back to this idea of selling your shares for income in a bit.

Dividends Drop the Stock Price

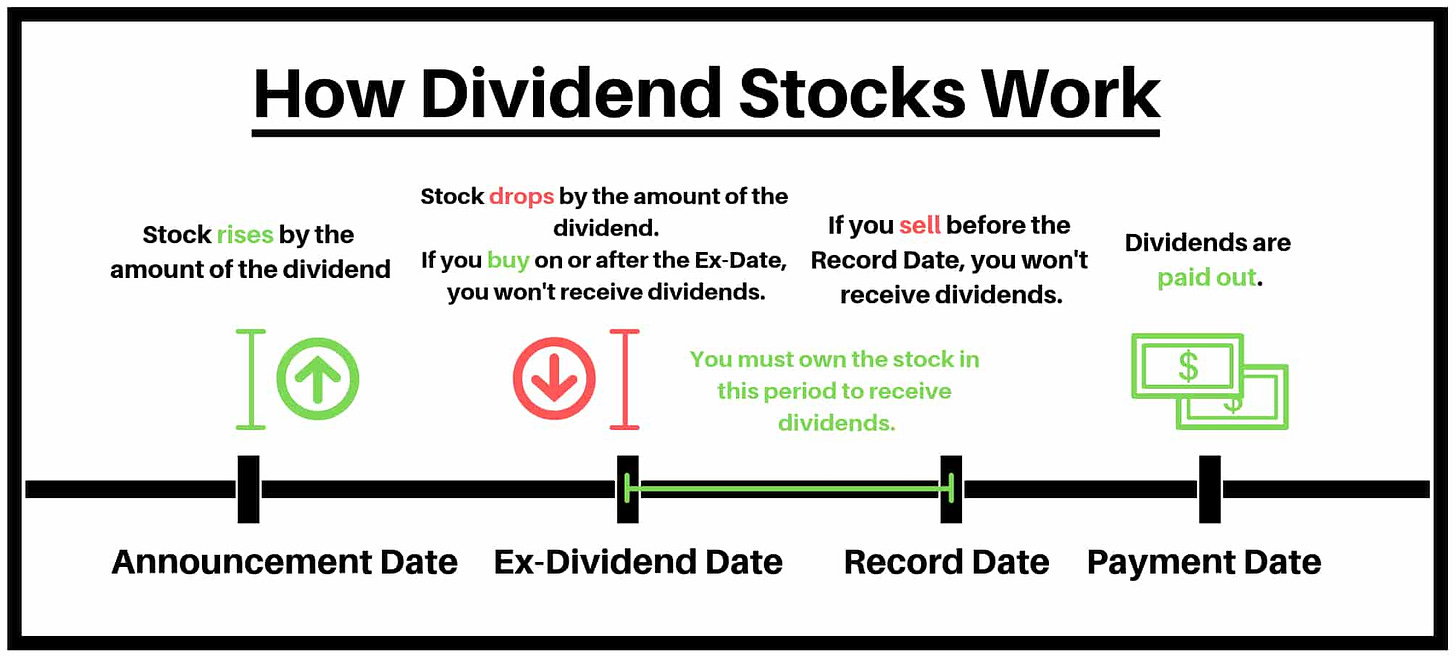

This is one of my favorite dividend myths. That the stock price drops by the amount of the dividend when it’s paid.

On the ex-dividend date, a stock theoretically opens lower by the dividend amount.

But that’s just accounting math. Like moving money from one pocket to another.

But the real world isn’t that simple.

Stock prices move based on expectations - future earnings, investor sentiment, and confidence in the company.

If a business keeps earning, growing, and paying steady dividends, buyers will keep showing up.

Think about it:

If prices always dropped by the full dividend and stayed down, the yield would rise…

And rise…

And eventually become too attractive to ignore.

Example:

If a $100 stock pays $5/year, that’s a 5% yield.

If the price "drops and stays" at $80, the yield is now 6.25%.

At $60? That’s 8.3%.

Eventually, buyers pile in.

So yes - dividends theoretically reduce the stock’s value in the moment.

But over time, markets price the business, not just one payout.

Here’s a video from the YouTube channel with the math:

You Can Just Sell Shares

Most of the people arguing that you shouldn’t care about dividends will tell you that you should focus on business quality.

Just buy great businesses - who cares if they give you cash?

If you need cash, you can just sell some shares - that’s what Buffett says about Berkshire!

Let’s see how that works out in 2 different scenarios.

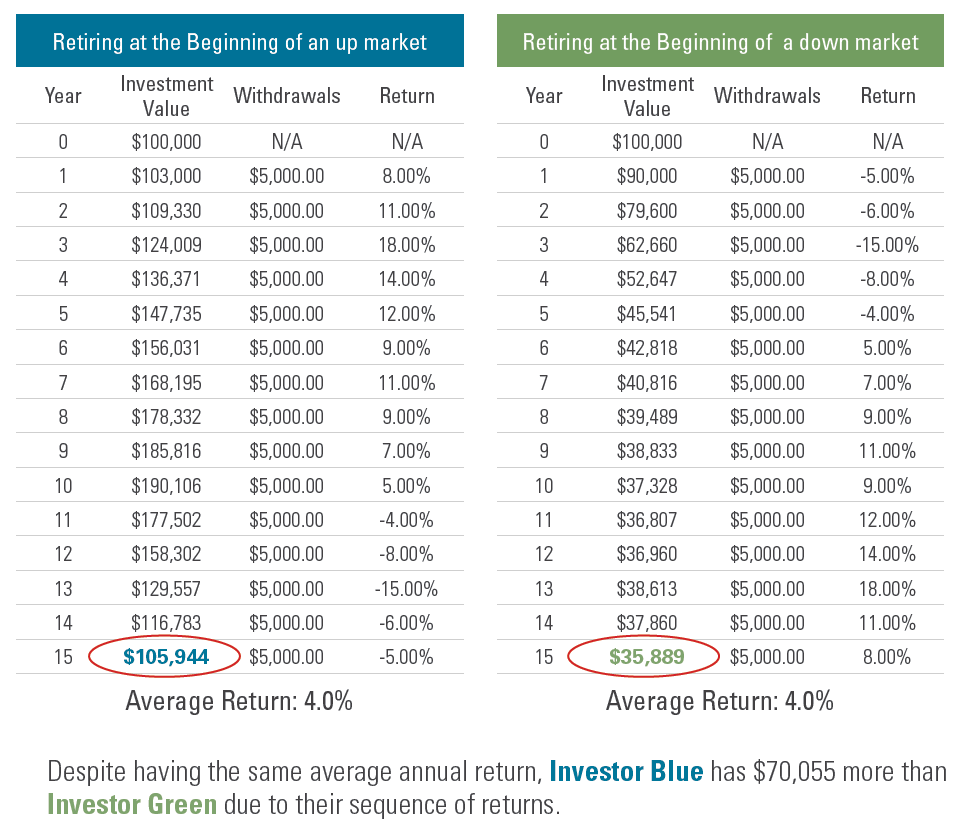

These investors have the same return. The only difference is when the returns come.

If the value of your stocks drop early in retirement, you wind up with a lot less in your account than if the value drops later.

This is called ‘sequence of return risk’ and it’s very real, and very dangerous.

It’s the difference between running out of money, and not.

You know who doesn’t care about this at all?

The investor with a 5% portfolio yield and collects their $5,000 in dividends every year without selling a share.

Let’s really think through this argument:

If you avoid dividends, what you’re really saying is this:

You should buy great businesses (hard to do - there aren’t that many truly great businesses) and hold on to them for the long-term (until you retire and need to buy groceries), then sell them off small piece by small piece.

That’s not how I want to invest - I wrote about it here.

Buybacks Are Better

I like a buyback (when done right) as much as anyone.

But, a buyback is a capital allocation decision - just like a dividend.

And management has to get it right. They don’t always.

When should management pay dividends or buy back shares?

Our friend Brian Feroldi has a great flowchart for capital allocation:

If the business has invested in the available attractive opportunities, doesn’t need to payoff debt, and the profits are sustainable, then it’s time to return capital to shareholders.

A regular dividend is a great start

When the stock is significantly below intrinsic value, buybacks can be added

What if You Avoid Dividends?

Let’s say you’re still unconvinced - that you still don’t like dividends.

What if you actively avoid them?

What happens?

You’re Avoiding Return

Dividends are a large part of the total return of the S&P 500 in every single decade.

Anywhere from 25% to 131% - do you really want to give that up?

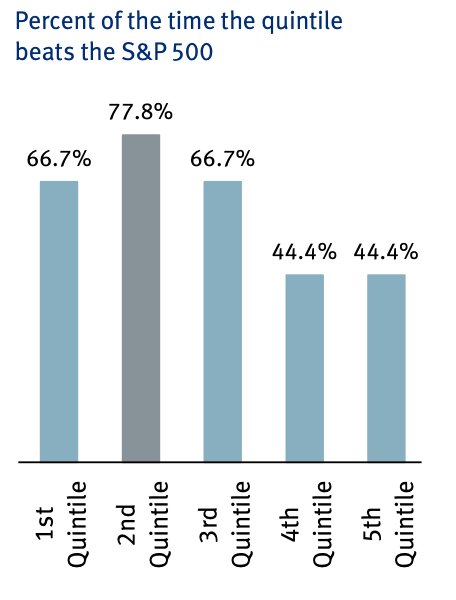

And dividend payers tend to beat the overall market - here they are broken down by quintiles based on yield.

The top 60% of dividend yielders tend to beat the market more than half the time.

You Make Holding Your Stocks Harder

Avoiding dividends means you’re signing up for more volatility.

Now, I’m not arguing that volatility is risk - if 2 stocks return an average of 10% over 5 years, it doesn’t matter how they get there - as long as you keep holding them.

The problem is that if one stock is a lot more volatile than the other, a lot of investors are going to sell the volatile stock early and not wind up actually getting the gain.

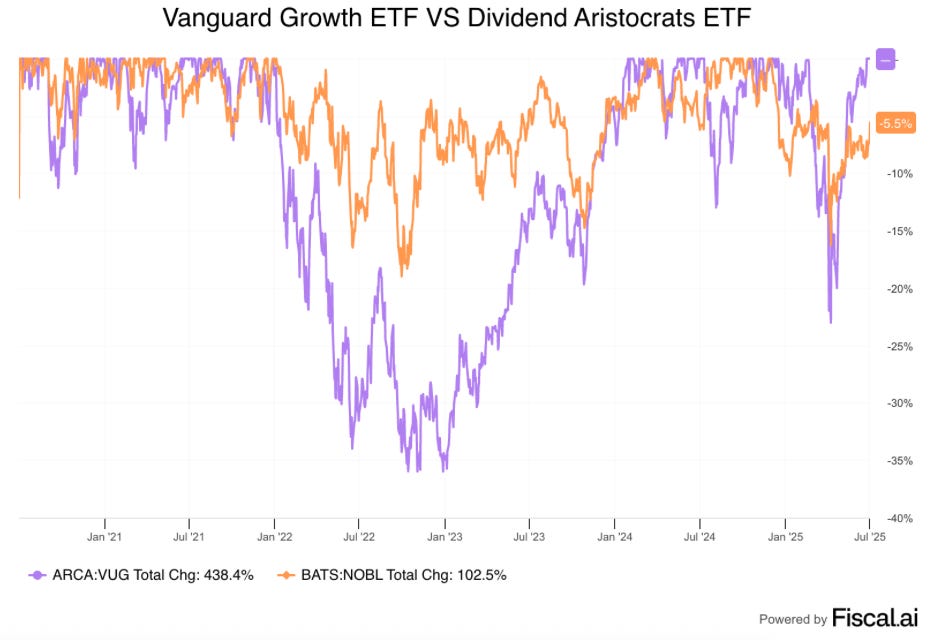

Here’s a simple example - in 2022, growth stocks dropped 40%.

Dividend Aristocrats? Only 20%.

Which do you think is easier to hold?

Which one do you think people actually did hold?

Here’s the Bottom Line

So what do we really learn from all this?

Yes, dividends get taxed.

Yes, stock prices dip on the ex-date.

Yes, you can sell shares for income.

But when you run the numbers, actually model the real-world risks…

And when you consider how humans actually behave with their money…

Dividends win.

They give you income without needing to sell

They reduce volatility

They make your portfolio easier to hold

And they protect you from the biggest threat to your retirement: sequence of return risk

You don’t have to hope the market is up when you need cash.

You just get paid - quarter after quarter - without lifting a finger.

And that’s the real power here.

You’re not just investing in stocks…

You’re building a personal income machine.

One that grows, compounds, and pays you to hold on.

Which do you think you’re more likely to stick with?

That’s the real question.

And the answer is simple.

Dividends work. Always have. Always will.

One Dividend At A Time,

TJ

YouTube

Don’t forget to subscribe to the Compounding Dividends YouTube channel here

Used sources

Interactive Brokers: Portfolio data and executing all transactions

Fiscal.ai: Financial data