What We're Really Buying

It’s not tickers or charts. It’s ownership in cash-producing machines.

Joel Greenblatt once said

“Stocks are not just pieces of paper that bounce around. They are ownership shares of businesses that you value and try to buy at a discount.”

It’s a simple idea. But in today’s market - where people trade based on charts, factor models, and what the Fed might do next - it’s easy to forget.

At Compounding Dividends, we haven’t forgotten.

We believe the best way to buy a stock is the same way you’d buy a local business:

Find a business with a track record of growth

Make sure the future looks bright and it has good management in place

Pay a price that makes sense based on the cash it will generate for you over time

That’s it.

We’re not betting on price charts or screen-based strategies. We’re buying cash-producing businesses at reasonable prices - and we’re holding them.

Why?

Because businesses create value. Prices fluctuate, but dividends are real cash flow.

They give us a steady return that doesn’t depend on someone else paying more later.

Greenblatt calls this value investing. We just call it common sense.

Stocks Are Not Tickers - They’re Businesses

Warren Buffett drilled the same idea as Greenblatt into his 2022 letter when he said his goal was:

“To make meaningful investments in businesses with long‑lasting favorable economics and trustworthy managers.”

Notice the boldface on businesses. Buffett and Greenblatt are pointing at the same bull’s‑eye—cash flow, not ticker symbols.

The Bakery on Main Street

Picture a small bakery in your town.

Sales have climbed every year

The ovens are paid for and still humming

The owner keeps 20 ¢ of every dollar spent inside

If the owner wants to retire and offers you half the shop, you would not think about flipping the business in a week or two or check last week’s flour prices.

You would ask one thing:

“How much cash will this bakery hand me every year, and am I paying a lot less than that stream is worth?”

That question is how Joel Greenblatt and Warren Buffett define value investing: figure out what the business is worth, then pay a lot less. Everything else is noise.

How We Think About Business Value

We always use 3 methods to value a company:

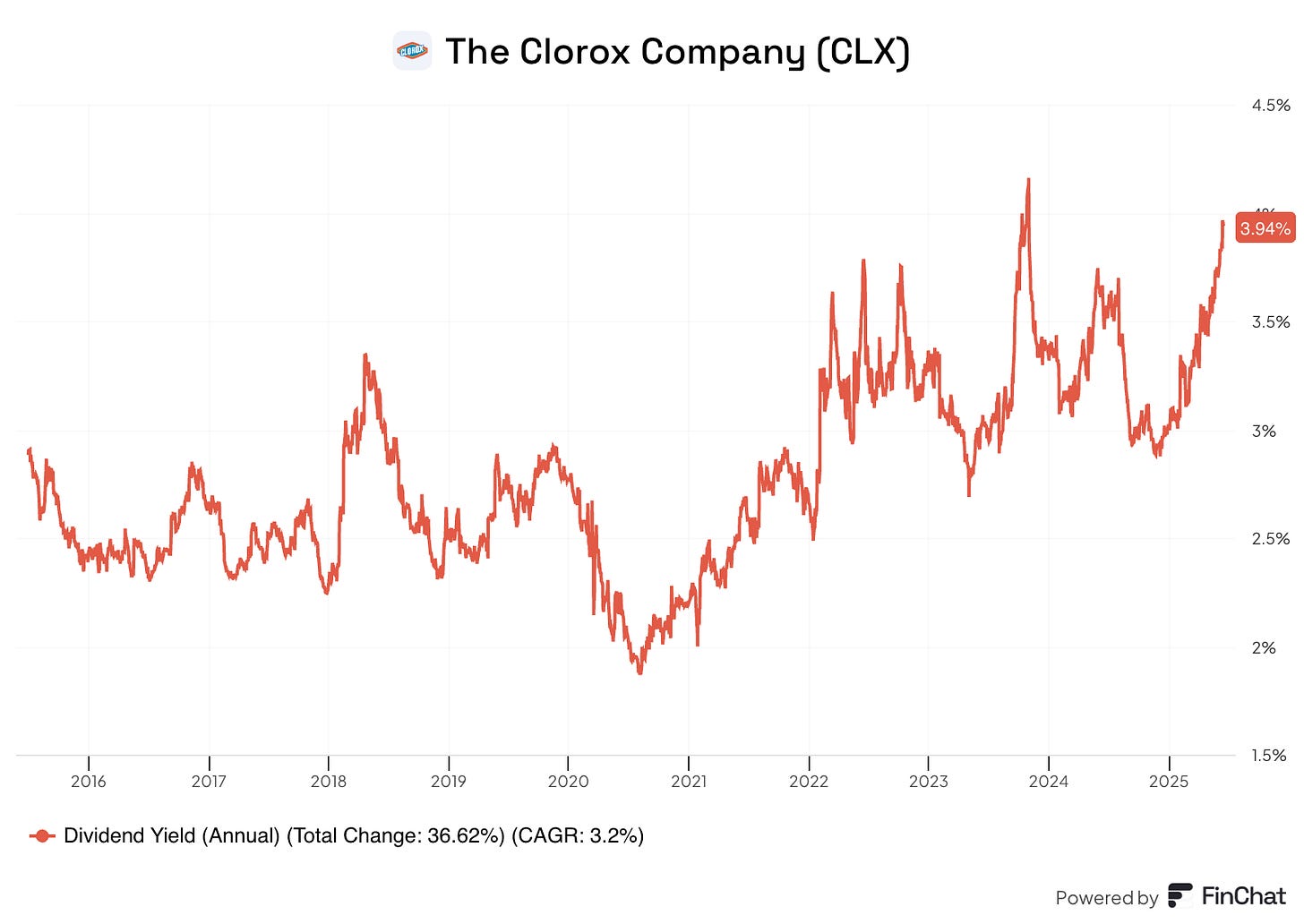

A comparison of the dividend yield with its historical average

An Earnings Growth Model

Reverse Dividend Discount Model

A comparison of the dividend yield with its historical average:

A higher than average yield indicates that the company might be undervalued.

An Earnings Growth Model

This shows us the yearly return we can expect from a company.

It takes into account growth of earnings, the shareholder yield, and multiple contraction or expansion.

The formula looks like this:

Expected return = Earnings Growth + Shareholder Yield (dividends + buybacks) + Multiple Expansion (or contraction).

A reverse Dividend Discount Model:

Valuing a company is complex.

Solving complex problems is often easier backwards, so that’s exactly what we do with the Reverse DDM.

This method tells us the dividend growth priced in by the market.

The formula looks like this:

Expected growth = Required return – (DPS next year / Current share price)

Your Action Plan

For your next investment, run the bakery test.

Ask yourself, does this business:

Have growing sales?

Have healthy margins?

Return a growing stream of cash to the owners?

If it passes those criteria, read the last few shareholder letters and annual reports.

Do you trust the managers?

If you trust the management, then we can move on.

Set a fair value on realistic cash‑flow assumptions. Pay less.

Then, you have to do the hardest part:

Do nothing. Let the business work, collect your share, and repeat.

Closing Thought

In a few hours, the market will open with flashing lights and fresh worries. None of that changes the math Greenblatt, Buffett, and plain common sense agree on:

1. Buy great businesses

2. Pay a sensible price

3. Hold while you collect steady income and watch your wealth grow.

Everything else is noise.

Used sources

Interactive Brokers: Portfolio data and executing all transactions

Finchat: Financial data