Why This Cash Machine Continues To Be Our #1 Stock

British American Tobacco continues to be our best performing stock.

The total return of British American Tobacco is more than 60% so far.

It’s just had a trading update, let’s see how the company is doing.

Our Investment

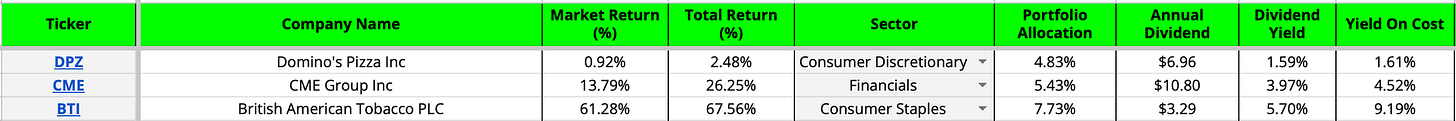

We bought British American Tobacco in January as the third stock for the Compounding Dividends Portfolio.

You can read the original investment case here.

Here’s a quick summary of why we bought it:

High Dividend Yield & Low Price: The stock was priced attractively with a very high dividend yield of 8.6% compared to the average of 7.7%.

Strong Cash Flow: BAT showed negative accounting earnings due to non-cash charges, but it generated very strong cash flow.

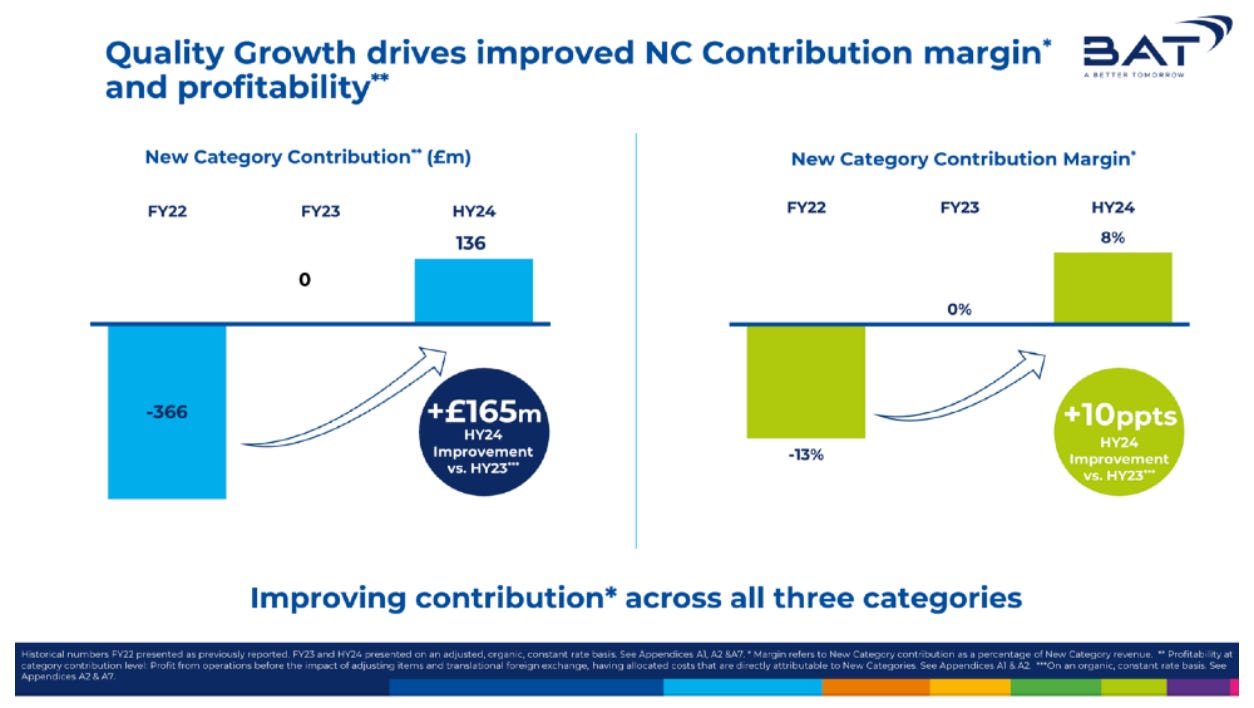

Growth Drivers: New, non-traditional products were growing quickly and had just become profitable, which meant another source of cash flow to grow the dividend.

Buybacks: Management had decided to start share buybacks, signaling that the shares were undervalued.

Performance

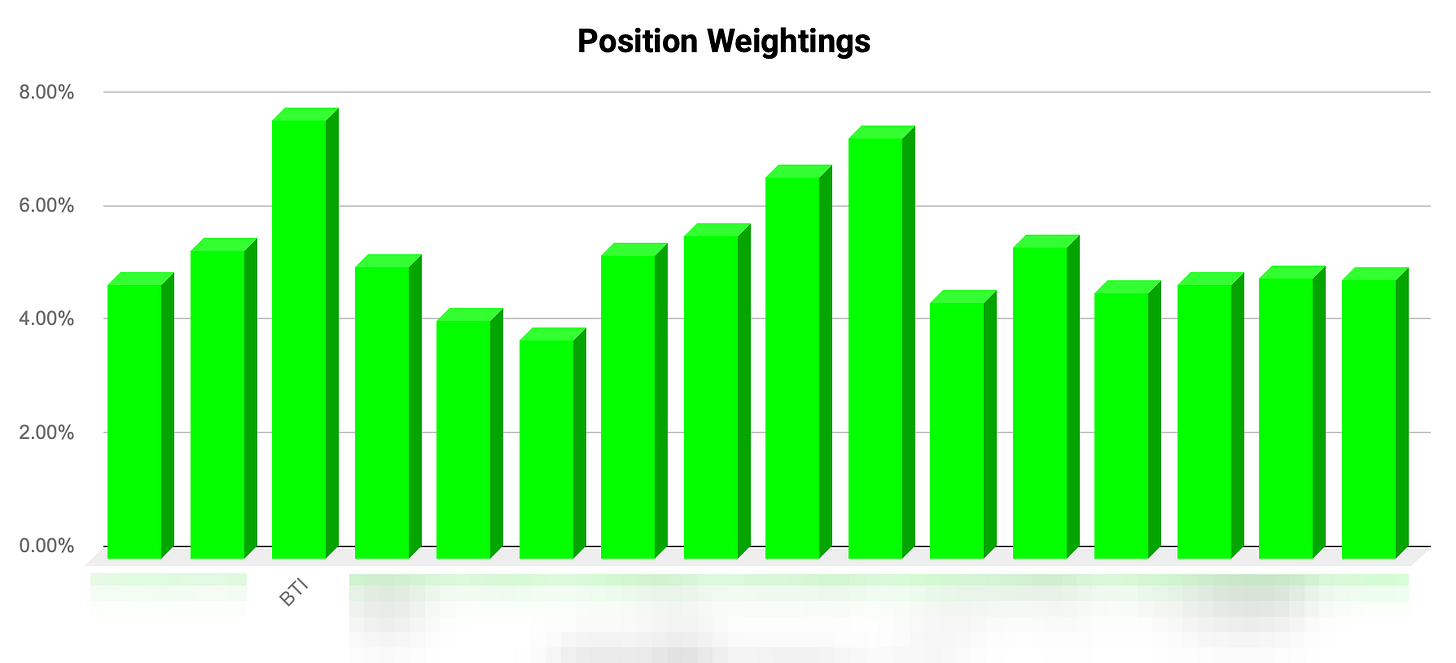

British American Tobacco has grown to be the largest position in Our Portfolio.

It’s also got the highest yield on cost in the portfolio and provides about 15% of our dividend income every year.

Now let’s get to the company’s most recent update.

Financial Highlights

Group Revenue Growth: Expecting 2% growth at constant rates for FY25.

Adjusted Profit from Operations: Expecting 2% growth at constant rates for FY25.

New Category Revenue: Growth is speeding up to double-digit growth in H2, they’re expecting mid-single digit growth for the full year.

Cash Flow: Operating cash flow conversion expected to exceed 95%

Share Buy-backs: Announced an increase in the buy-back program to £1.3 billion for 2026.

Deleveraging: On track to reduce leverage to within the 2.0-2.5x adjusted net debt/adjusted EBITDA target range by the end of 2026.

2026 Guidance: Reaffirmed mid-term growth: +3-5% revenue, +4-6% adjusted profit from operations, and +5-8% adjusted diluted EPS (expected at the lower end of the range).

The takeaway?

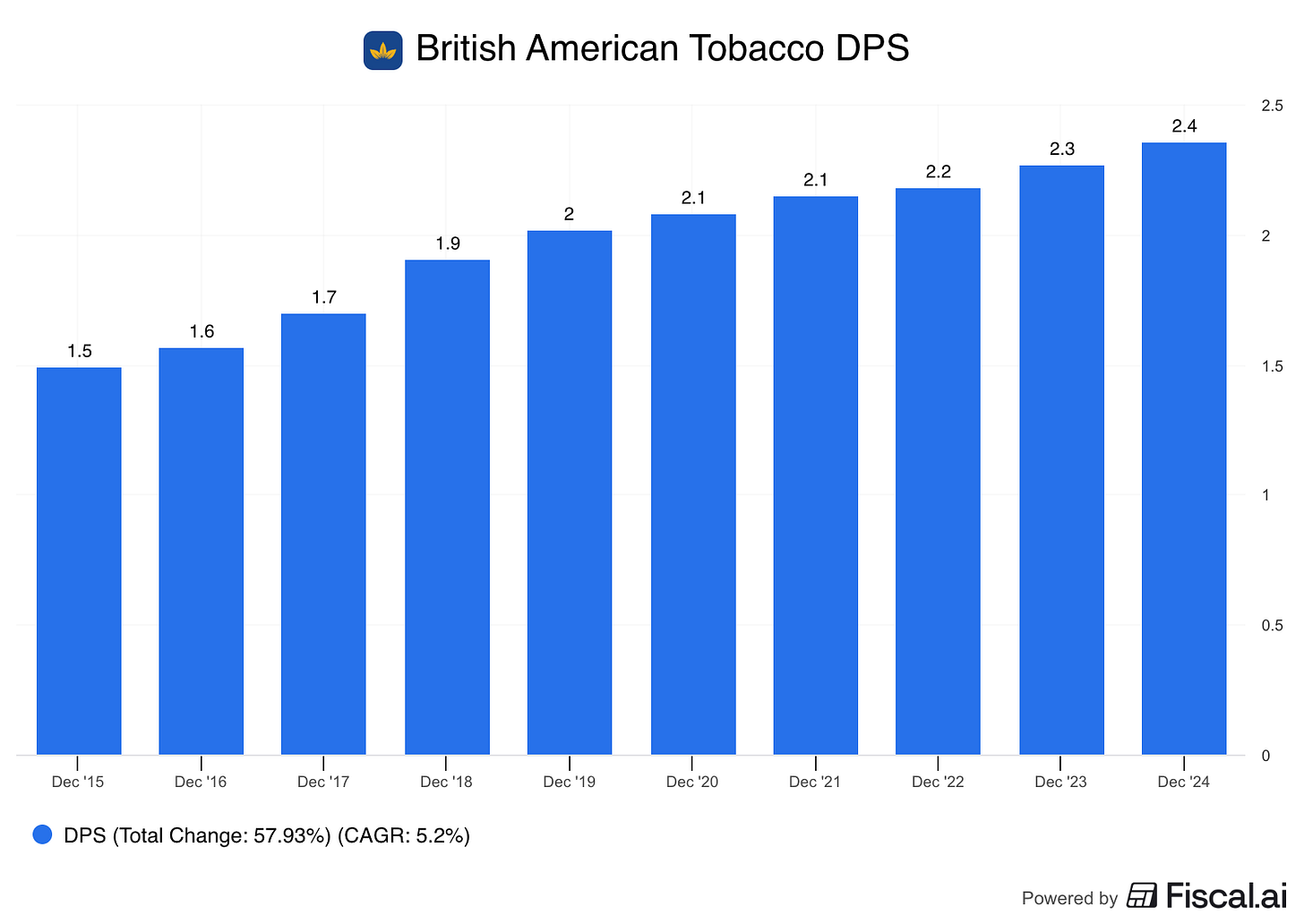

British American Tobacco should be able to continue to grow the dividend at rates that will keep up with inflation.

Let’s dive into a few more highlights from this update.

Other Highlights

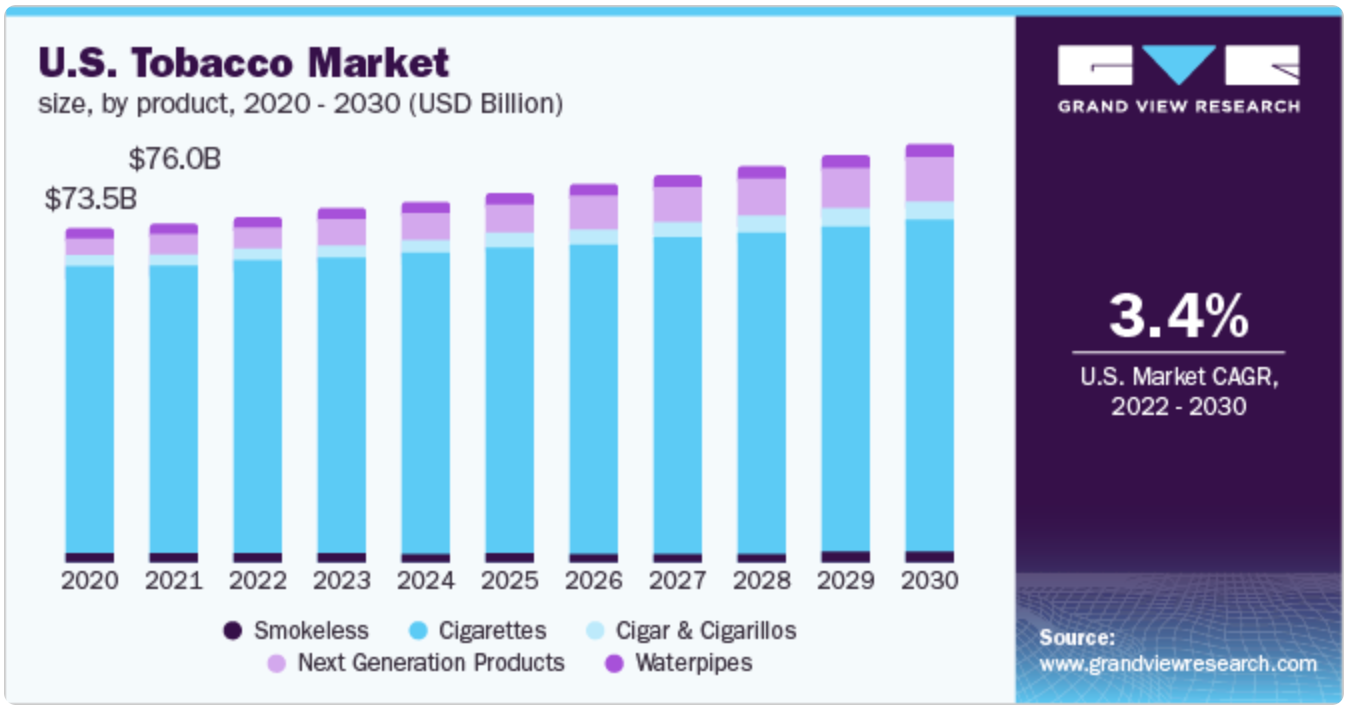

U.S. Combustibles: The U.S. combustibles business is expected to deliver both revenue and profit growth in FY25 for the first time since 2022.

Velo: Velo (modern oral) is driving strong global growth. In the U.S., Velo Plus is seeing triple-digit revenue growth and is on track for full-year profitability.

Vuse Recovery: U.S. Vuse (vaping) revenue returned to growth recently due to enforcement against illicit products.

Headwinds: Performance in APMEA (Asia Pacific, Middle East, and Africa) was impacted by fiscal and regulatory challenges in Bangladesh and Australia, lowing that group’s revenue by ~1%.

Dividend Commitment: Management reiterated their commitment to a progressive dividend alongside the buy-backs and deleveraging efforts.

The growth in U.S. cigarette profitability is very good news.

Even though the new categories are growing very quickly, U.S. cigarette sales are still the biggest driver of profits for British American Tobacco.

Earnings Call Quotes:

“I remain committed to delivering sustainable shareholder value supported by robust cash returns, progressive dividends and sustainable share buy-backs, and I am pleased to announce today that we are increasing our buy-back programme to £1.3bn for 2026.”

CEO Tadeu Marroco explicitly tells us that returning cash to shareholders remains a top priority. The increase in the buy-back program also tells us that management thinks the company is attractively valued.

“We expect to be within our 2.0-2.5x adjusted net debt/adjusted EBITDA target range by end 2026...”

The company is within a year of being able to be back to their targeted leverage. Once this target is hit, it gives them flexibility for even more return of capital to shareholders in the future.

“In the U.S., the Modern Oral category value is expected to almost double over the next two years and has already overtaken the size of the legitimate vapor category at around £2 billion. Velo Plus is the fastest-growing U.S. Modern Oral brand. It has already reached the number two volume and value share category position, gaining 15 percentage points of volume share since launch.”

BAT is seeing very strong growth in Velo Plus in the U.S.

“Vapor remains the largest new category in terms of number of adult consumers and continues to demonstrate strong conversion effectiveness... While the vapor category continues to be impacted by the proliferation of illicit products, we are encouraged by early signs of performance recovery in the U.S., where Vuse has returned to volume and revenue growth in recent months after 18 months of decline and gained 70 basis points of value share year-to-date to reach 50.4%.”

Vapor has returned to growth as well in the U.S. and the increased enforcement against illegal products by the government is still in the early stages.

Summary

This was a nice and stable update.

The stabilization of the U.S. combustible segment is very good news, so is the enforcement against the illegal vape products.

The growth in the ‘new categories’ like Velo is also very encouraging and important, because those are going to be the future drivers of profits.

We also love to see the high cash conversion, commitment to the dividend, increased buybacks, and debt pay down.

British American Tobacco should continue to pay us large dividends that can grow at least as quickly as inflation.

An Update on Another Position

The market thinks AI will disrupt this business.

That fear is everywhere.

But the latest earnings told a very different story.

This company just posted record revenue tied to AI.

And AI is driving more work across the rest of the business too.

We bought the stock recently.

It’s already up 14%.

Not because AI replaced them.

But because companies can’t use AI without them.

AI doesn’t cut them out.

It pulls them in deeper.

Paid subscribers got the full update.

The numbers.

The dividend hike.

And why this “AI threat” narrative may be backwards.

Free subscribers can’t see that yet.

But you can get in line.

👉 Join the waiting list for a limited number of discounted spots coming later in 2026.

Sometimes the best opportunities look misunderstood.

One Dividend At A Time,

-TJ

Used sources

Interactive Brokers: Portfolio data and executing all transactions

Fiscal.ai: Financial data