Why This “Safe” REIT Slashed Its Dividend by 45%

I wrote up Alexandria Real Estate Equities (ARE) a while back, and at first glance it looked like a solid high yield REIT with a dividend easily covered by profits.

But we didn’t buy it, and a few weeks ago, they cut the dividend by 45%.

Let’s show you what happened and what we can learn.

Alexandria’s Business

Alexandria is the premier landlord for the life science industry.

They own massive “Mega Campuses” in innovation hubs like Boston, San Francisco, and San Diego.

Their tenants are pharmaceutical giants, companies like Eli Lilly, Bristol Myers Squibb, and Moderna.

They also rent space to earlier stage life science companies and the research departments of large universities.

Even Google’s life science division Verily rents space from Alexandria.

For a long time, this was a steady, growing business.

But real estate relies on the health of its tenants.

Why the cut?

The issue isn’t Alexandria itself.

The issue is that Alexandria has put all of its eggs in the life science basket.

And life science and biotech companies are facing a perfect storm of issues right now.

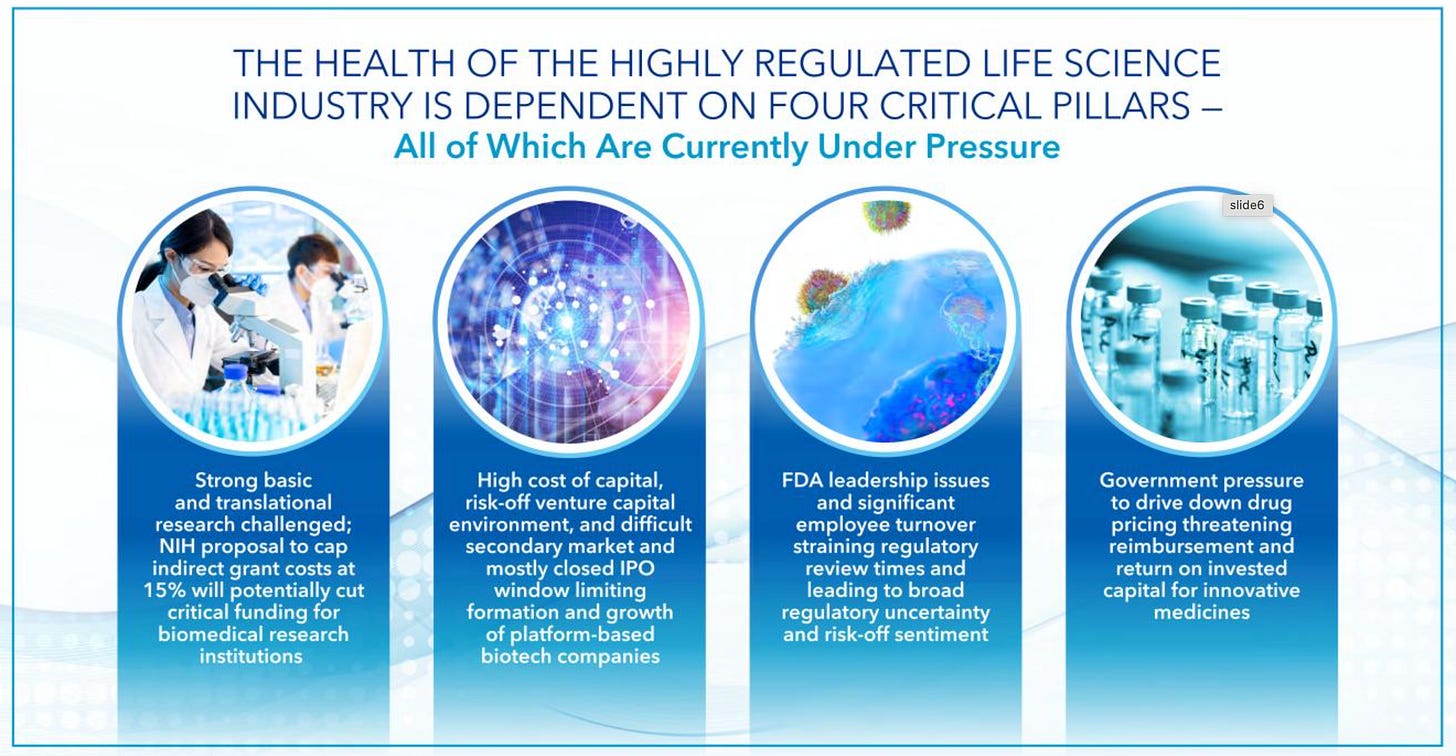

At their investor day, Alexandria’s management said that all 4 pillars of the industry are collapsing at once.

Basic science is being challenged: The NIH is making it much harder for universities and other scientists to get funding for the basic science that Alexandria’s customers build from

Venture capital is drying up: Many biotech start ups rely on venture funding to get started, which is drying up

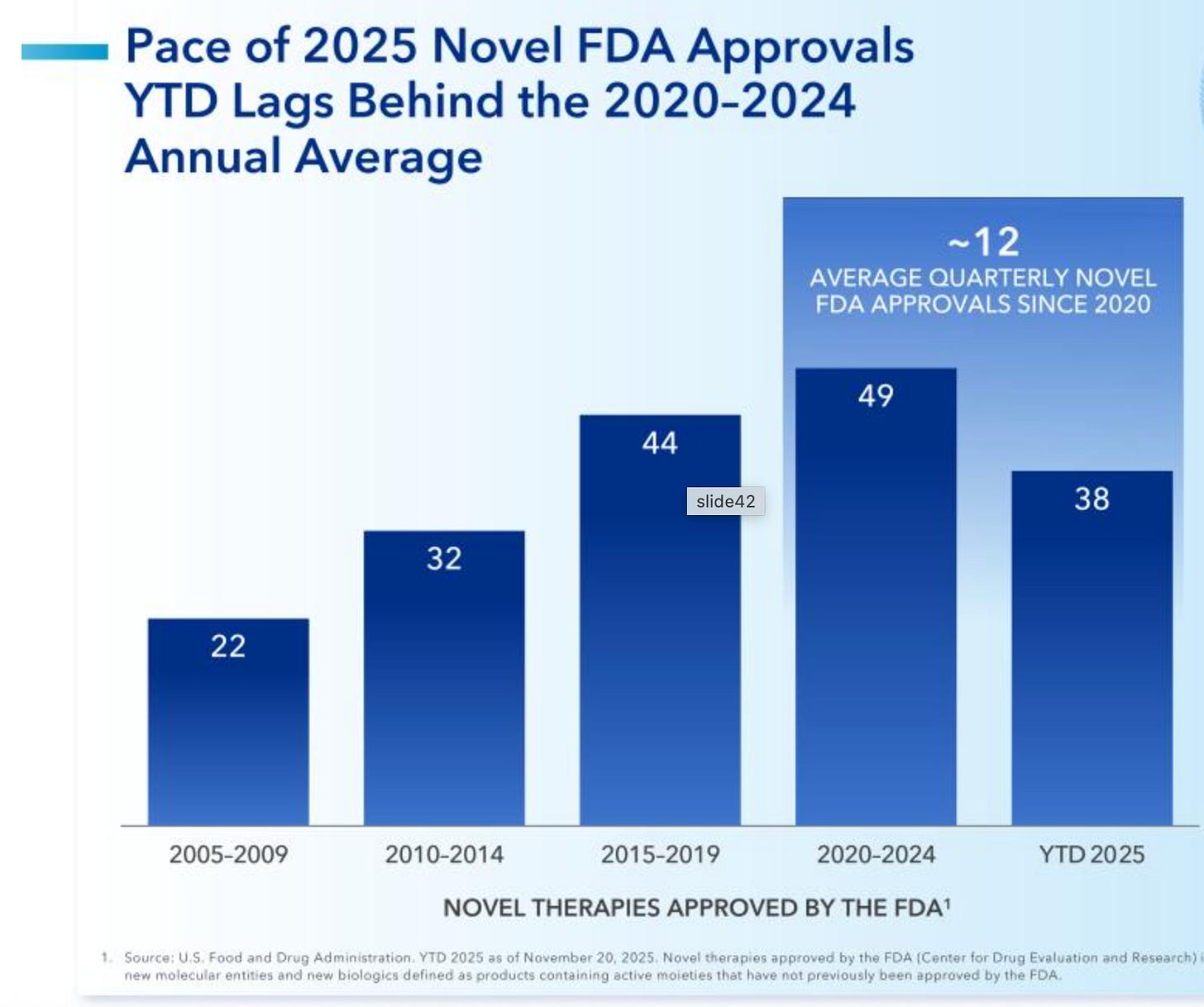

FDA turmoil: There’s lots of staff turnover at the FDA and approvals are being delayed

Pricing pressure: The U.S. government is pressuring pharma companies to lower drug prices, reducing profits

These headwinds against the life science industry, and their landlords, are structural and severe.

So, the board decided to cut the dividend to preserve their balance sheet.

Let’s go through each of these issues briefly and show you how the affect Alexandria’s tenants.

Basic Science Funding

The National Institute of Health is an important source of funding for biotech and life science companies.

A study published in JAMA Health Forum showed that the NIH spent $187 billion for basic or applied research related to 354 of the 356 drugs approved by the FDA from 2010-2019.

That means that NIH dollars helped fund essentially every new drug of the last decade.

The study found that the NIH spent about as much money as the the biopharmaceutical industry for each new approved drug.

NIH funding is very important, but it’s under a lot of pressure right now.

The Trump administration wants to dramatically cut the NIH budget by 40% and consolidate the agency from 27 institutes into 8.

So far, Congress has rejected this idea.

But even if the budget doesn’t get cut, the administration seems intent on slowing things down and making funding difficult.

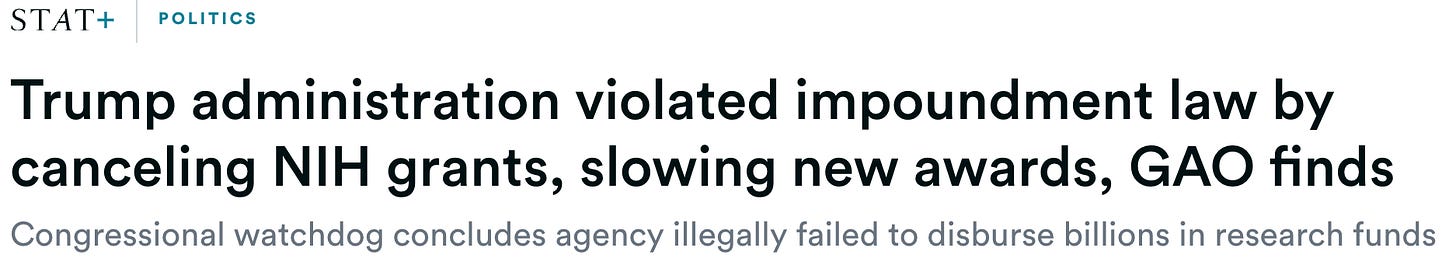

In August, the Government Accountability Office found that the Trump administration had illegally withheld funds by terminating over 1,800 NIH grants.

There was also an $8 billion shortfall in new and continuing awards between February and July, which is also said was an illegal withholding of funds.

The newest wrinkle is a proposed 15% cap on indirect costs, which would limit how much money universities can use from a research grant to cover overhead expenses.

These are things like:

Lab Maintenance and Utilities (lights, heat, water for the building).

Administrative Staff (HR, payroll, security, grant managers).

Compliance and Safety (IT security, hazardous waste disposal).

It’s currently blocked by the courts, but all of the uncertainty around funding is making universities and other scientific institutions that get NIH funding pull back on spending, which reduces demand for ARE’s properties.

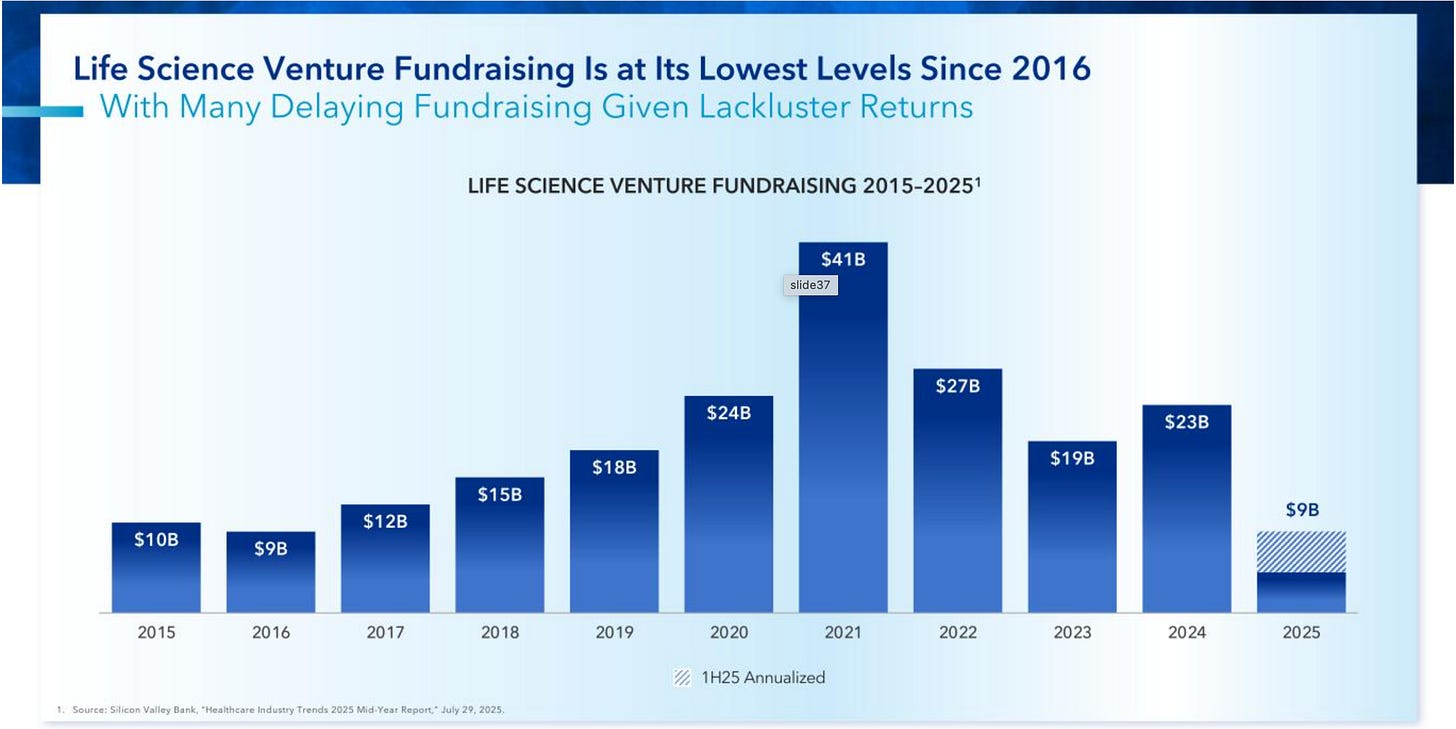

Venture Funding

Start up companies in the biotech and life science space typically rely on funding from venture capital to get started.

But interest rates are high, and the recent returns haven’t been good.

That means that that venture funding is also drying up.

Going public isn’t a great option for new life science companies either.

Demand and funding for new public offerings of these types of companies has been very weak for years.

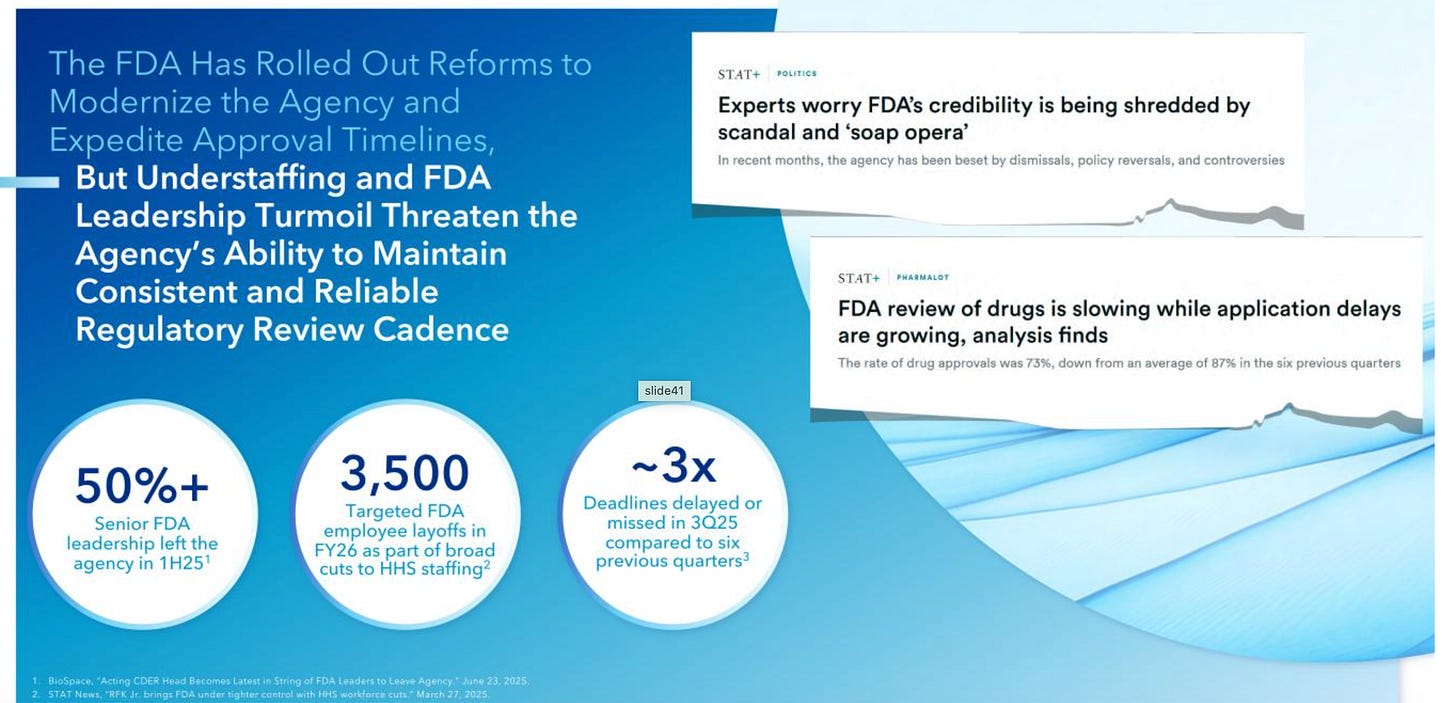

FDA Turmoil

Another issue in the industry is the FDA.

More than half of the senior leadership has left the agency in 2025, and 3,500 staff members are targeted for layoffs in 2026.

This has slowed down and delayed drug approvals and applications.

Even if you have the science you need, and the funding to stay in business, if you can’t get your new drug approved, you can’t pay rent.

Pricing Pressure

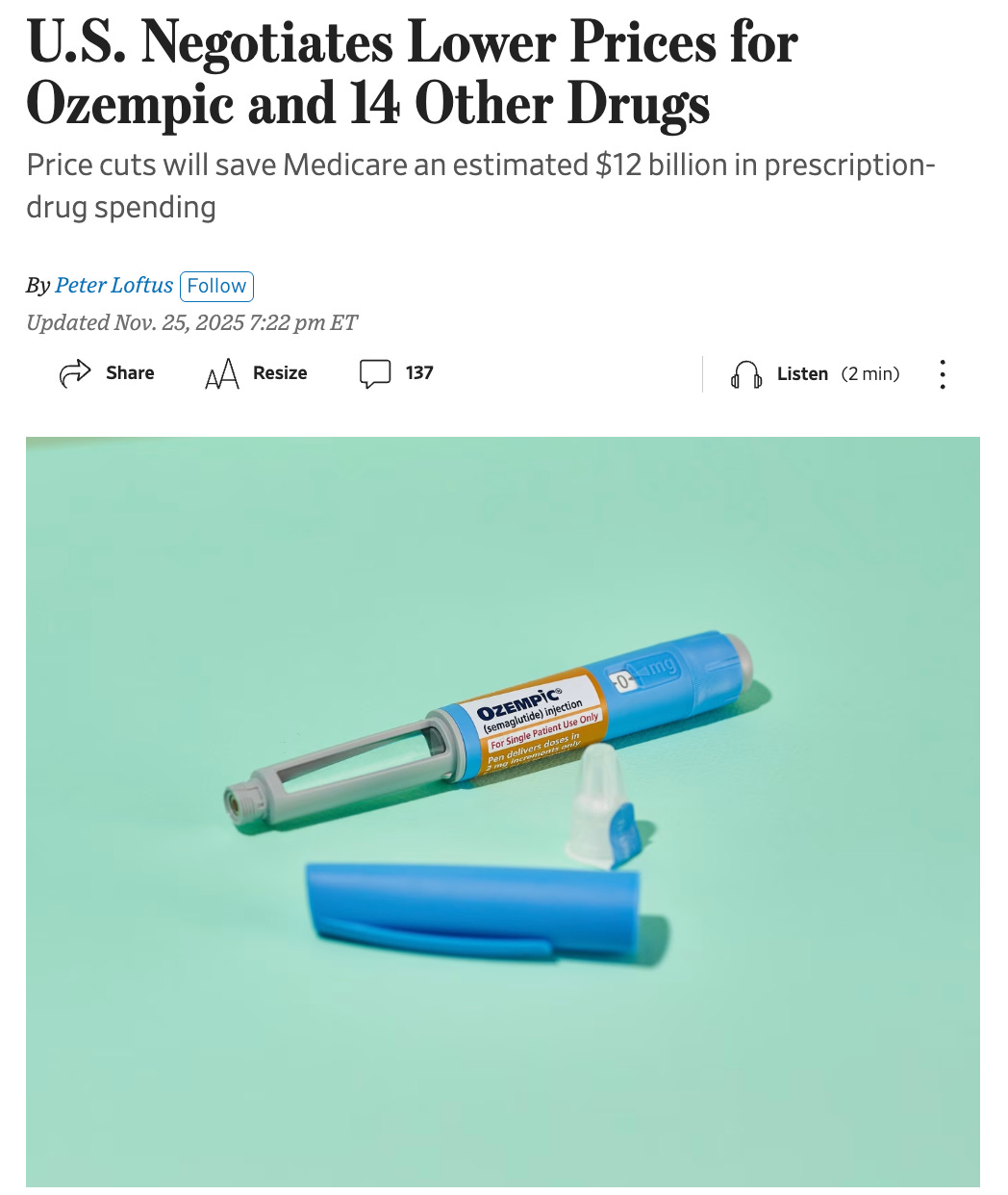

Last, even if you invent a cure, and manage to get it approved, the government is aggressively trying to lower drug prices.

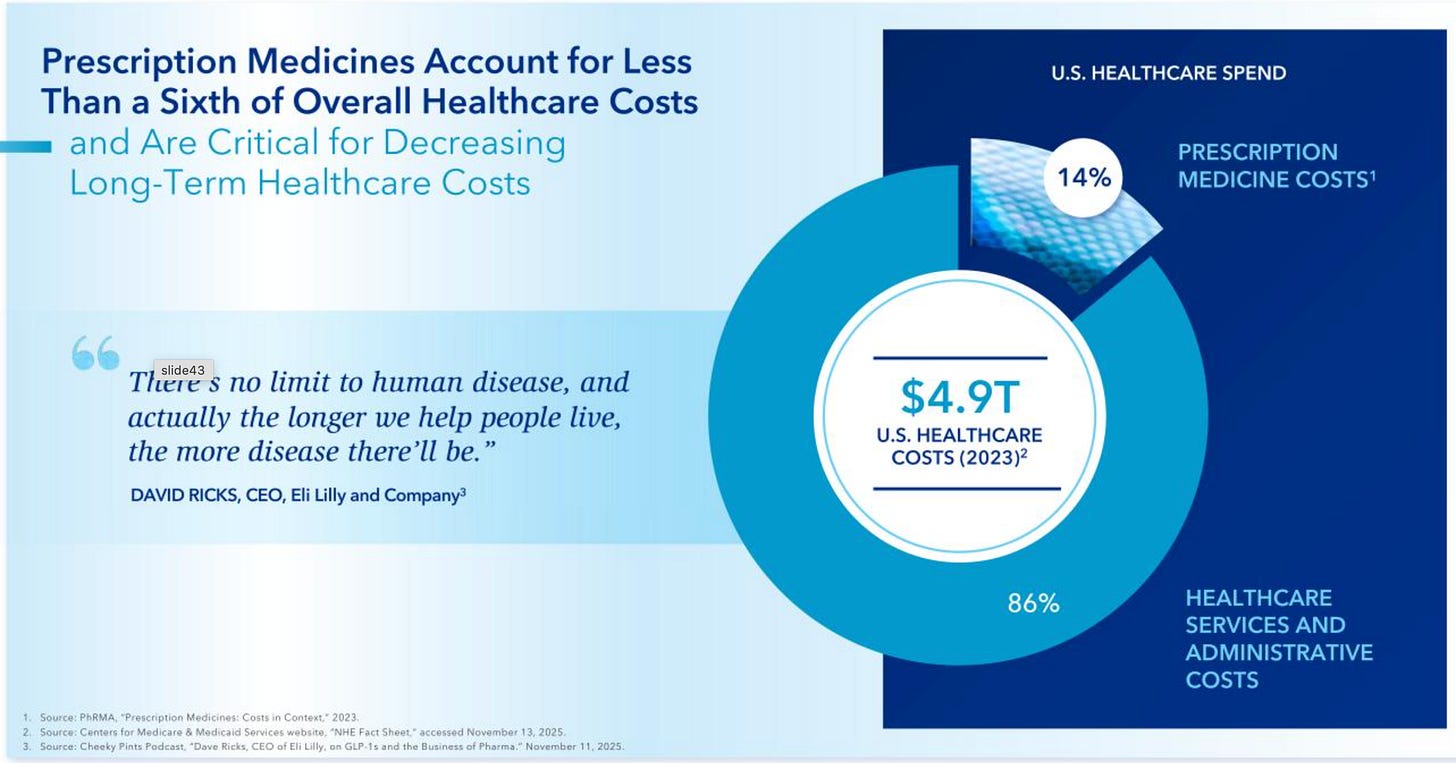

The industry is trying to argue that high drug prices are not the reason that U.S. healthcare costs are so high, and they might be right.

But going after ‘big pharma’ is politically popular, and the government has already negotiated lower prices on some of the most popular drugs available.

Lower margins for tenants mean lower rent checks for landlords.

The “Perfect Storm” of Industry Headwinds

Extreme uncertainty and political pressure on the NIH is reducing new discoveries, and causing universities to pull back on spending.

Venture capital is tightening and focusing on later-stage companies, while the public offering (IPO) market for new life science firms remains too weak to provide growth capital.

Massive turnover in FDA leadership and staff layoffs have caused delays in drug approvals, creating a bottleneck that prevents companies from commercializing products and generating revenue

Government efforts to negotiate and lower drug prices directly reduce profit margins for biopharma companies, which ultimately translates to lower revenue and less ability to pay high rents

Alexandria’s Current Business Environment

Obviously, Alexandria’s tenants are in for a tough time, but it’s not like Eli Lilly or of Pfizer is suddenly closing up shop.

They still need lab space, and Alexandria’s leases are generally long term.

On top of all of the issues for Alexandria’s tenants, there’s an issue that directly affects Alexandria itself.

An oversupply of space.

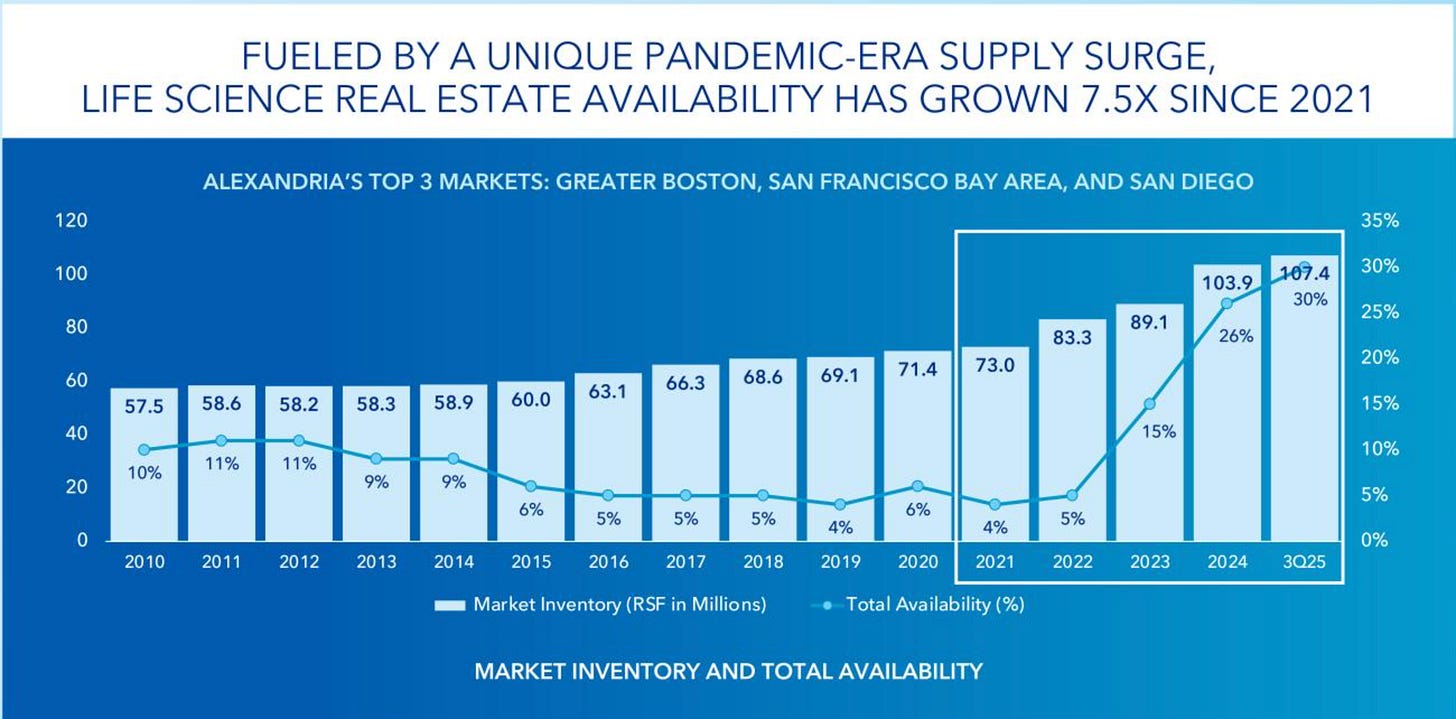

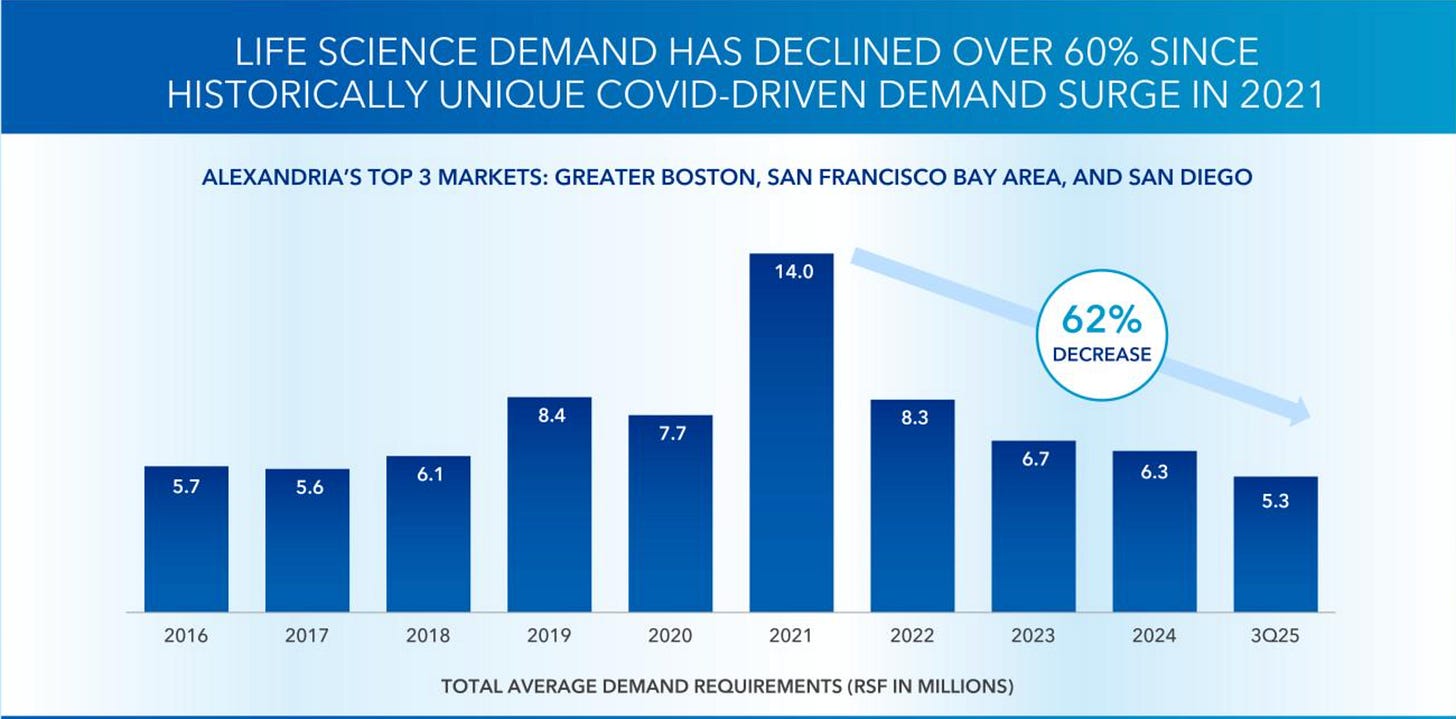

Life science real estate has grown 7.5x since 2021.

At the same time, demand has dropped by 60%.

More supply and less demand means more vacancy and lower rents for Alexandria.

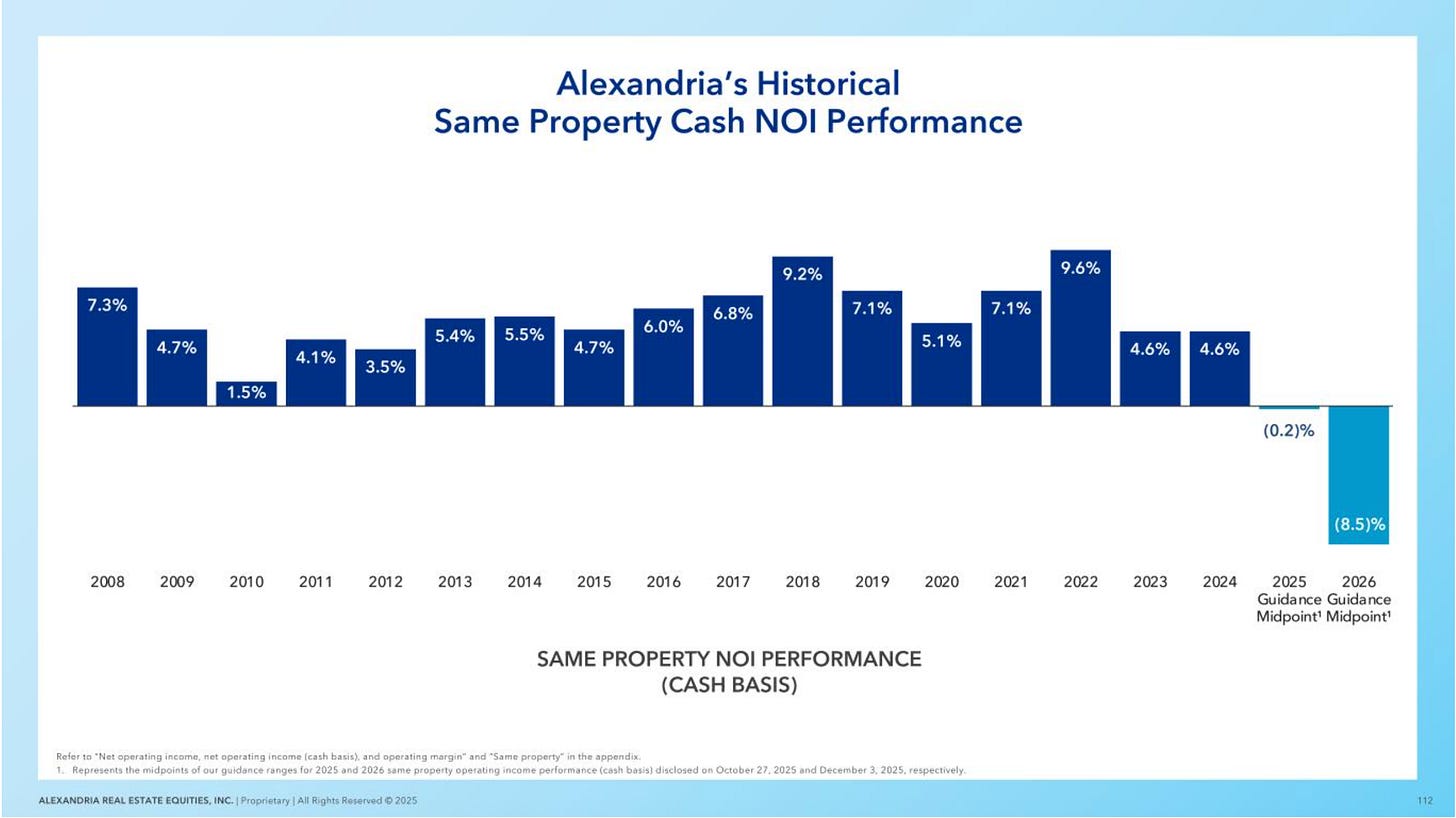

Management expects each building to make about 8.5% less on a cash basis in 2026 than it will this year.

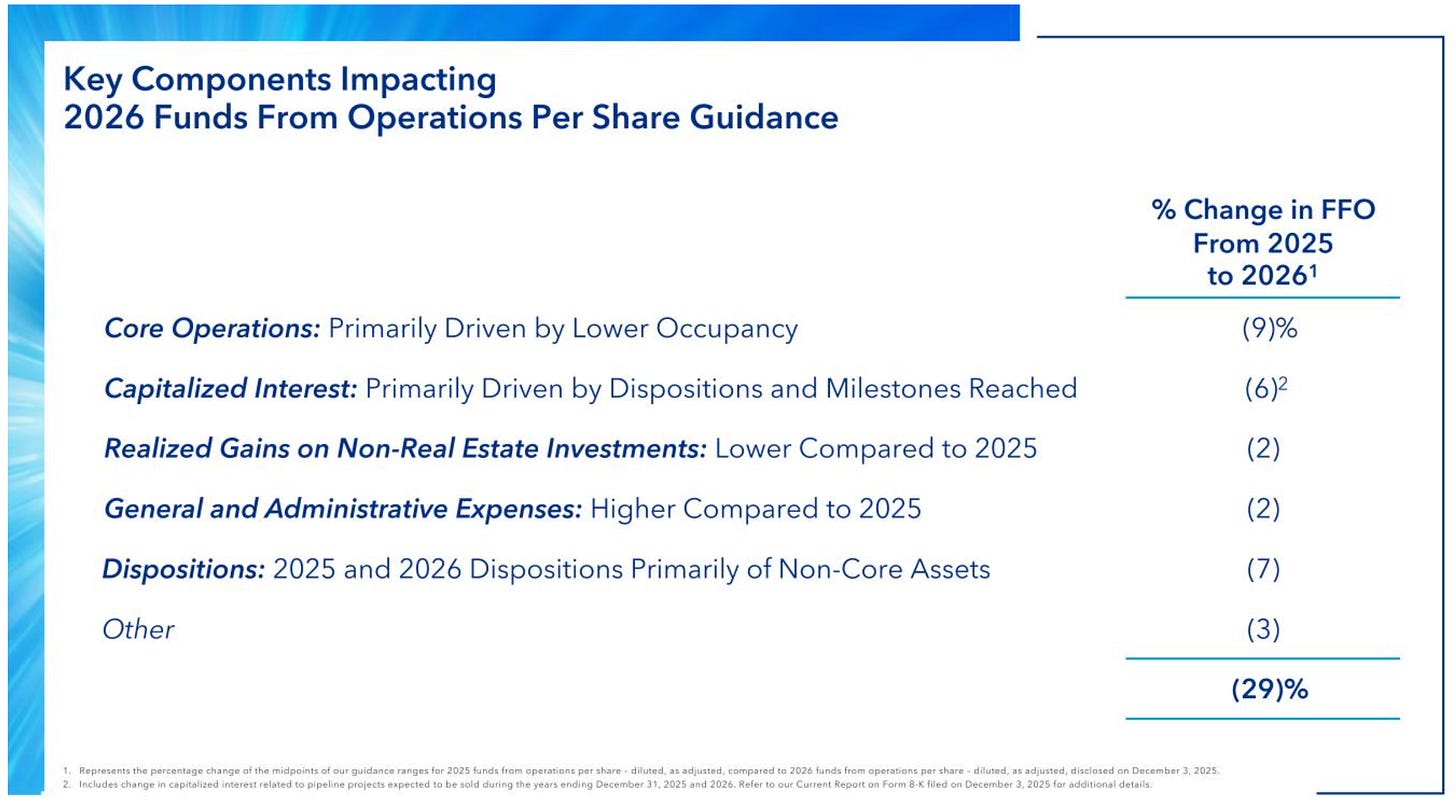

They also expect a drop in FFO of nearly 30% between 2025 and 2026.

If the dividend had not been cut, it would have put Alexandria at a payout ratio of 80% or more, even without a dividend raise.

Could investors have seen it coming?

This one was trickier than Dow.

If you looked at Alexandria’s past financials, they looked like a fortress. Rent collection was high, and the dividend was covered.

But with a REIT as concentrated in one area as Alexandria is, you also have to look at the industry risks.

And if you did, the warning signs were flashing red.

Political Risk: The administration was in the middle of cutting NIH grants, and proposing lower budgets. Secretary Kennedy was talking about banning government scientists from publishing in journals.

Interest Rate Risk: High rates had already frozen the VC money that fuels biotech growth.

Supply Risk: Alexandria had been talking about the oversupply of lab space in their communications with investors.

The Conclusion: What can we learn?

Alexandria is a well-managed company with a strong balance sheet, and great assets.

But it’s connected at the hip to the life science industry.

When the government, the FDA, and the capital markets all turn against that industry, the landlord is going to get hurt too, even when they own the best buildings.

Always remember that we’re buying businesses, and your dividend payment comes directly from the current and future earnings of that business.

Alexandria cut the dividend because the future earnings power of the business has fundamentally changed.

One Dividend At A Time,

-TJ

Used sources

Interactive Brokers: Portfolio data and executing all transactions

Fiscal.ai: Financial data