💸 You’re Selling Yourself Short (Literally)

The Dividend Truth Wall Street Doesn’t Want You to Know

Picture this...

You’re on vacation and you walk into a prime pizza place.

The owner greets you with a smile - turns out he’s an old friend from college.

Business is booming. Tables packed. Cash register singing.

You start catching up and he tells you that he’s thinking about expanding into another hot vacation spot. But the interest rates the banks are offering him are ridiculous.

He asks if you’d be interested in buying a small part of the business to fund the expansion.

You say yes. Smart move.

How Business Ownership Works

A year later, the pizza parlours are making even more money. Customers love them. The business is rolling in dough (pun very much intended).

So what’s your college buddy do?

He hands you an envelope with cash inside. Your share of the profits. Just like that.

You still own your piece of the restaurant. But now you've got spending money too.

Makes perfect sense, right?

Now here's where it gets weird...

Wall Street Doesn’t Want You to Own Businesses

Wall Street has convinced millions of people that this simple idea - getting paid as a business owner - is somehow wrong.

They've got a different plan for you.

Their plan? Sell a piece of your ownership every time you want money.

It's like that restaurant owner saying, "No, I’m not paying you any cash. But hey, you can always sell me back a chunk of your ownership if you need spending money."

Sounds crazy when you put it that way, doesn't it?

Yet that's exactly what happens when you rely on capital gains.

Every time you sell stock for money, you're giving up ownership. You're becoming less of an owner and more of a... well, a seller.

Daniel Peris - an author and Senior Portfolio Manager at Federated Hermes - said something recently that hit me like a ton of bricks:

"Capital gains force you to reduce your ownership. Dividends don't."

Read that again.

This one sentence destroys everything they teach in business school about investing.

Theory Versus Practice

The professors will tell you that dividends are wasteful. They'll say companies should keep all their money and grow, grow, grow.

But here's what they don't tell you...

CEOs aren't perfect - shocking, I know.

They buy corporate jets. They chase bad acquisitions, or try to get into new lines of business. They spend millions on Super Bowl ads to show off to their friends.

Meanwhile, you sit there hoping your stock price goes up so you can sell some shares and actually see a return.

That's not investing. That's gambling.

Dividends Make You An Owner

Dividends cut through all the nonsense.

They're simple. Direct. Honest.

The company makes money. You get paid. No guesswork. No hoping. No relying on Mr. Market being in a good mood when you need cash.

You get a check. Period.

And here's the beautiful part - you still own your shares.

You're getting paid to be an owner, not selling your ownership to get paid.

It's the difference between collecting rent on a property versus selling off pieces of your house every time you need money.

Which sounds smarter to you?

Look, I get it. The finance world loves to complicate things. They throw around fancy terms and theories that sound impressive.

But strip away all the jargon and ask yourself this simple question:

If you own a piece of a profitable business, shouldn't that business pay you?

Of course it should.

That's what real ownership looks like.

So the next time some advisor tells you to focus on unrealized capital gains instead of dividends, ask them this:

"If I own part of a great business, why would I want to sell it?"

Watch them stumble around for an answer.

Because deep down, they know the truth.

You're not supposed to be a seller.

You're supposed to be an owner.

And owners get paid.

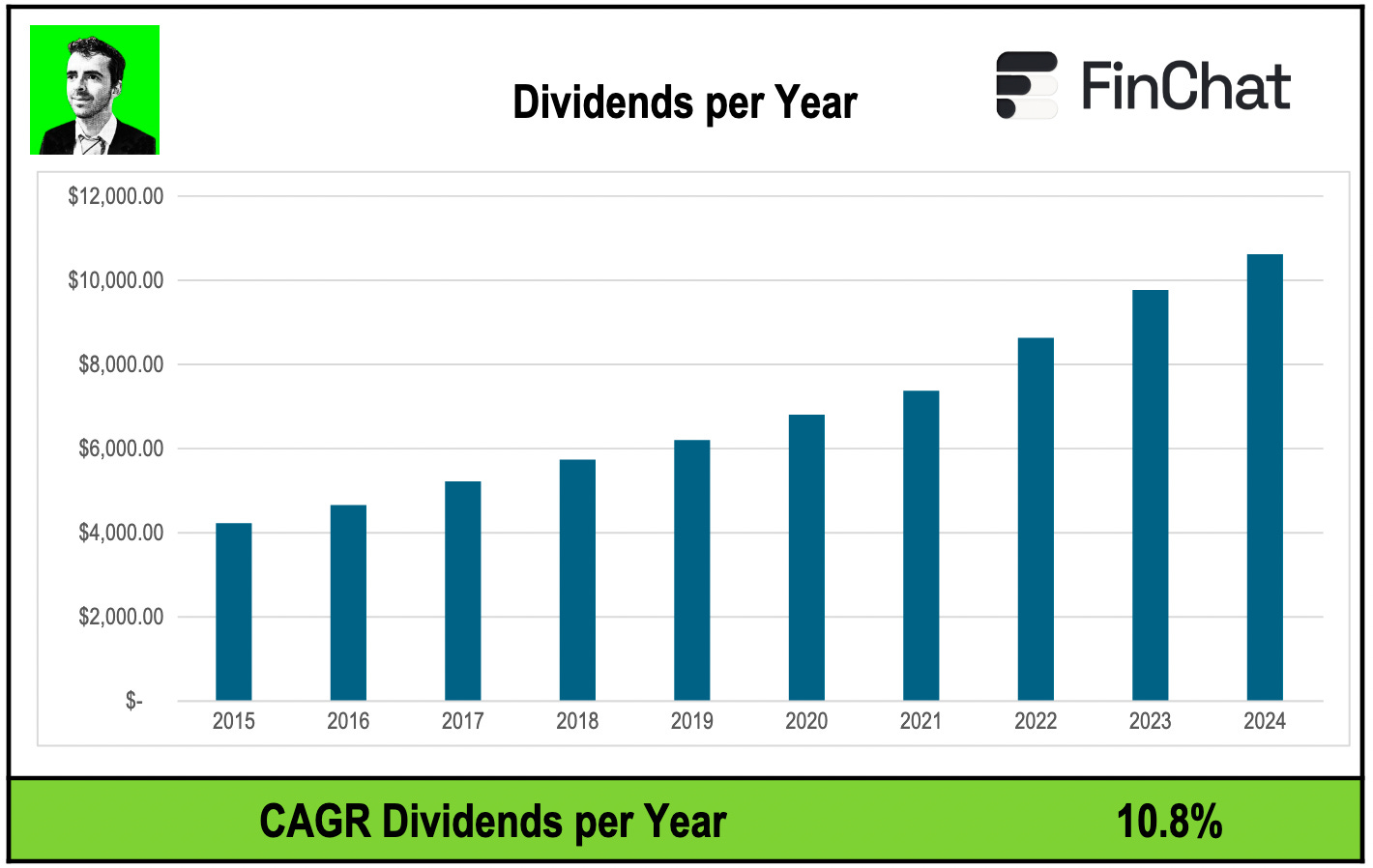

Reinvest those dividends into more business that pay you and you can watch your income grow, just like the income from Our Portfolio:

One Dividend at a Time,

-TJ

P.S…

This is exactly why smart investors look for companies like our most recent buy - businesses that pay you to own them, not because they have to, but because they’re so profitable that they can. And because paying owners is simply the right thing to do.

Become a paid partner and see the research on this business, as well as every other business we own in Our Portfolio.

Used sources

Interactive Brokers: Portfolio data and executing all transactions

Finchat: Financial data