3 Most Undervalued Dividend Kings Now

Dividend Kings are the companies that have grown their dividends for at least 50 consecutive years.

There are only 53 companies that belong to this best-of-breed group.

Maintaining such a long history of dividend growth requires durable competitive advantages and long-term earnings growth.

Even better, investors can opportunistically purchase Dividend Kings when they are undervalued, which could lead to superior returns over time.

Note: Click here to instantly download your free list of all 53 Dividend Kings now.

These 3 Dividend Kings have increased their dividends for over 50 years, and are significantly undervalued, leading to expected returns above 10% per year.

Question for you

Would you be interested when a full Compounding Dividends service would roll out just like we do for Compounding Quallaity?

This service would include:

A Compounding Dividends Portfolio

Full investment cases

A Community

And much more!

Farmers & Merchants Bancorp (FMCB)

Farmers & Merchants Bancorp is a locally owned and operated community bank with 32 locations in California. Due to its small market cap and its low liquidity, it passes under the radar of most investors. Nevertheless, F&M Bank has paid uninterrupted dividends for 88 consecutive years and has raised its dividend for 58 consecutive years.

In the first quarter of 2024, the bank grew its adjusted earnings-per-share 4% over the prior year’s quarter, from $29.44 to $30.56. It posted 8% growth of loans and 9% growth of deposits. Net interest income dipped -7% due to a contraction of net interest margin amid higher deposit costs. Management remains optimistic for the foreseeable future, as the 23-year high interest rates are likely to continue to support a wide net interest margin.

We expect 5.0% annual earnings-per-share growth over the next five years. A contributor to growth will be the new branch in Oakland, which opened in the fourth quarter of 2021.

F&M Bank is a prudently managed bank, which has always targeted a conservative capital ratio. The bank currently has a total capital ratio of 14.2%, which results in the highest regulatory classification of “well capitalized.”

Moreover, its credit quality remains exceptionally strong, as there are extremely few non-performing loans and leases in its portfolio. The conservative management results in lower leverage and thus slower growth than leveraged banks during boom times but protects the company from recessions.

With a 2024 P/E of approximately 8 against our fair value of 12, FMCB stock appears undervalued. An expanding P/E multiple from 8 to 12 could boost annual returns by 8.6% per year. In addition to expected EPS growth and the 1.8% dividend yield, total returns could reach 15.2% per year over the next five years.

Tootsie Roll Industries (TR)

Tootsie Roll Industries, Inc. traces its roots back to the late 1890’s when its namesake product, the Tootsie Roll, was first created. Today, the company sells a wider variety of candy and gum products. Other well-known brands include DOTS, Junior Mints, Andes, Charms, Blow-Pops, Sugar Daddy, and Dubble Bubble. T

Tootsie Roll reported Q1 2024 results on April 24th, 2024. Net sales were down 6% to $151.5 million for the quarter. Diluted EPS increased 16% to $0.22 per share from $0.19 on a year-over-year basis. Although revenue growth is slowing in 2024, margins are higher because of lower freight costs and higher prices.

Inflation is a concern and input costs are rising for labor, ingredients, freight and delivery, fuel, packaging materials, energy and manufacturing supplies impacting profit margins and net profits. The company raised prices in response.

Tootsie Roll is expected to generate 3% earnings per share growth moving forward to 2029, mostly via small amounts of revenue growth driven by incremental product innovation and price increases. Influences on earnings per share growth include commodity input and freight cost inflation on the downside, and volume and price increases and operational efficiencies to the upside. Earnings per share growth will also benefit from ongoing share buybacks.

TR shares trade for a 2024 P/E of 22, below our fair value estimate of 30. Shares also have a 1.2% dividend yield. Total returns are estimated at 10.7% per year over the next five years.

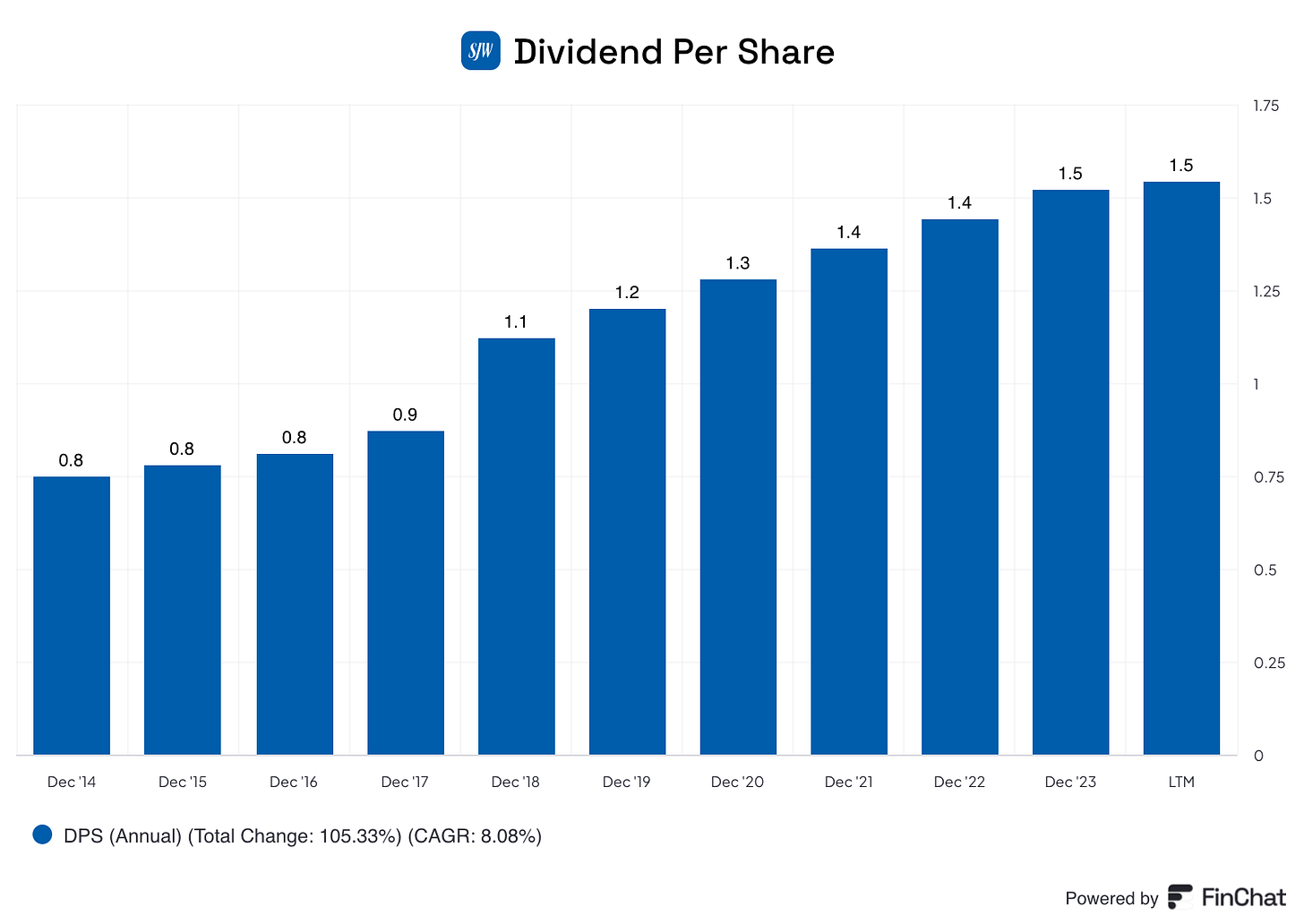

Source: Finchat

SJW Group (SJW)

SJW Group produces, purchases, stores, purifies, and distributes water to its customers. The company has a presence in a variety of high growth areas, including Silicon Valley and the area north of San Antonio, Texas. SJW Group also has a small real estate division that owns and develops properties for residential and warehouse customers in California and Tennessee.

On January 25th, 2024, SJW Group announced that it was raising its quarterly dividend 5.3% to $0.40, extending the company’s dividend growth streak to 56 consecutive years. SJW Group is a member of the Dividend Kings.

On February 22nd, 2024, SJW Group announced fourth quarter and full year results for the period ending December 31st, 2023. For the quarter, revenue declined slightly by 0.1% to $171.3 million, beating estimates by $10.3 million. Earnings-per-share of $0.59 was in-line with expectations.

For the year, revenue grew 8% to $670.4 million while earnings-per-share of $2.68 compared to $2.43 in 2022. The decline in earnings-per-share was primarily related to a delayed decision in the company’s general rate case in California that caused SJW Group to recognize a full year of revenue in the fourth quarter of 2022.

SJW Group provided an outlook for 2024 as well, with the company expecting earnings-per-share in a range of $2.68 to $2.78 for the year. At the midpoint, this would be a 1.9% increase from the prior year.

We continue to forecast that the SJW Group will grow earnings at the average growth rate of 8.0% through 2029 due to revenue growth and rate increases. Earnings-per-share growth is 15.1% for the past five years, an impressive growth rate for a water utility. Much of this growth is due to the merger with CTWS. We continue to forecast that the SJW Group will grow earnings at the average growth rate of 8.0% through 2029 due to revenue growth and rate increases.

A key competitive advantage for SJW Group, aside from the concluded merger, is that it operates in two areas, Silicon Valley and Central Texas, that have seen high levels of population growth in recent years. These areas need improved water infrastructure to serve a growing client base, so local governments often allow the company to raise rates at a relatively high level in order to fund these projects. The company applied for rate increases of 9.8%, 3.7% and 5.2% over the next three years for its California service areas.

SJW stock trades for a 2024 P/E of 20, which is below our fair value estimate of 26. The combination of multiple expansion, EPS growth and dividends results in expected returns of 15.6% per year over the next five years.

Source: Finchat

Disclosure: No positions in any stocks mentioned

That’s it for today

That’s it for today.

In case you missed it:

Used sources

Interactive Brokers: Portfolio data and executing all transactions

Finchat: Financial data

I Hope that if u wanna start a counpanding dividend platform such as coumpanding quality people like me might have a discount ;)

I would still argue there are better pickings from the REIT universe.