3 Questions That Help You Spot Great Businesses

Trying an Experiment

I’ve recorded a video of the same content that’s in the article, it’s below. If you prefer to read, scroll right past.

Either way, answer the poll at the end, so I know if it’s worth doing more of this!

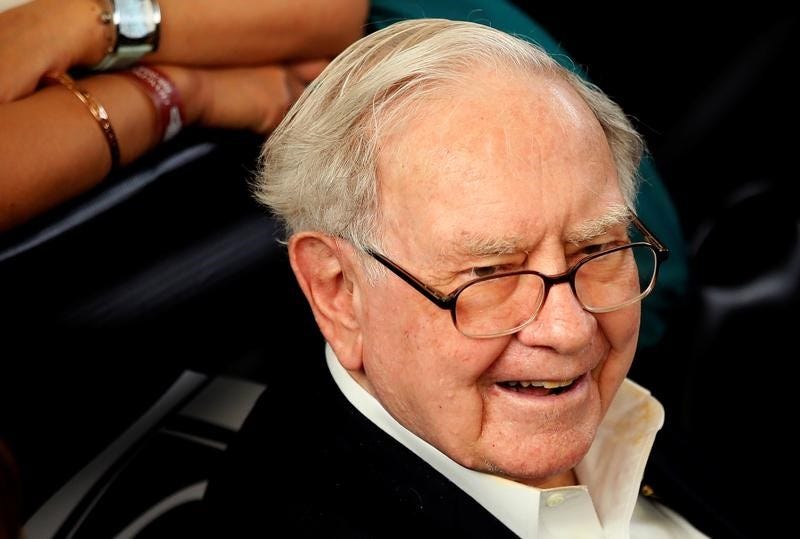

When I was in Omaha for the Berkshire Hathaway meeting, I heard three questions that really stuck with me.

They were simple. But they can tell you a lot.

Here they are - and why they matter:

2 Questions from Buffett

These two questions are meant to be asked of management.

They drill down into who management thinks is strong and who they think is weak in the industry, which can tell you a lot.

1. “If you had to invest in one of your competitors for the next 10 years, who would it be?”

Most investors ask management to talk about themselves.

That’s easy.

They’re trained for that.

But this flips the script.

It forces them to show who they admire.

Who they respect.

Who they fear.

And that tells you a lot.

About what really matters in the industry.

About what a great operator looks like.

2. “If you had to short one of your competitors for 10 years, who would it be?”

Now you’re looking for the dead weight.

The company with too much debt.

Weak margins.

Mediocre leadership.

This question reveals the landmines.

The ones to avoid.

But it also tells you something else:

Where the whole industry might be vulnerable.

Smart CEOs answer this carefully.

But they do answer.

And what they say can prevent mistakes.

Bill Ackman’s Question

Ackman held an event Friday afternoon at the Hilton.

I went to lunch with a few friends beforehand.

The first place was closed. Construction.

The second one? Just closed. No sign. No explanation.

The third place finally worked.

But by then, I was tight on time.

I found myself power-walking through Omaha like a man on a mission.

Then a thin man in a blue suit turned the corner in front of me.

It was Bill Ackman.

I hadn’t missed the event.

But Bill still beat me there.

He walks fast.

Here’s the question that made the power-walk to the event worth it:

3. “If this business disappeared tomorrow, would it matter?”

It sounds simple.

But it’s brutal.

Because if no one would notice,

then what’s the point?

This question tests a company’s importance.

Its place in the world.

Would customers panic?

Would supply chains break?

Would someone rush in to fill the gap?

Or would it quietly vanish into nothing?

This cuts deeper than any DCF model ever will.

Conclusion

These questions are great for investors.

They help you focus on what’s important very quickly.

Each question is simple, but cuts deep.

Great investors ask better questions - because the answers often reveal the truth faster than any spreadsheet.

Used sources

Interactive Brokers: Portfolio data and executing all transactions

Finchat: Financial data