💸 5 Dividend Secrets

Today is Dividend Day.

In this series, I will teach you 5 things about dividend investing in less than 5 minutes.

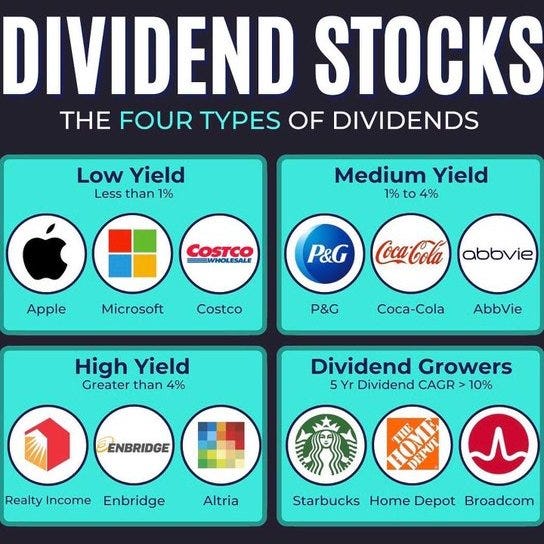

1️⃣ 4 Kinds of dividend stocks

Different investors prefer different types of stocks.

The image shows one way to categorize dividend stocks:

Low Yield Stocks: <1% dividend yield

Medium Yield Stocks: 1% to 4% yield

High Yield Stocks: >4% yield

Dividend Growers: Stocks that increase their dividend payment by 10% or more

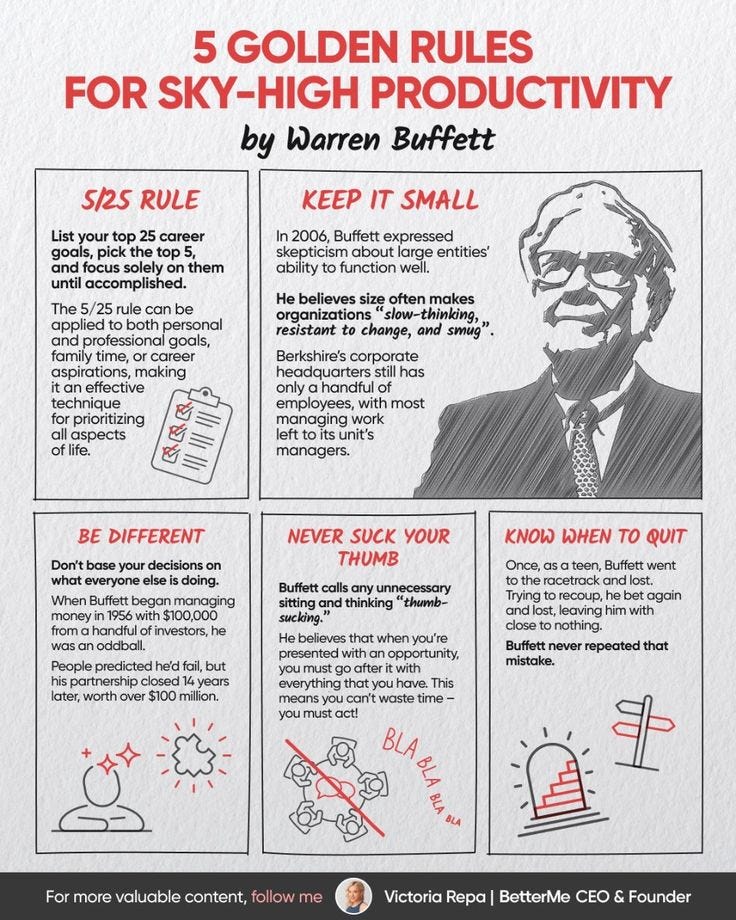

2️⃣ Buffett’s 5 rules

Warren Buffett gives great investing advice.

His tips can also help in life.

Here are 5 rules to improve your investment skills and productivity.

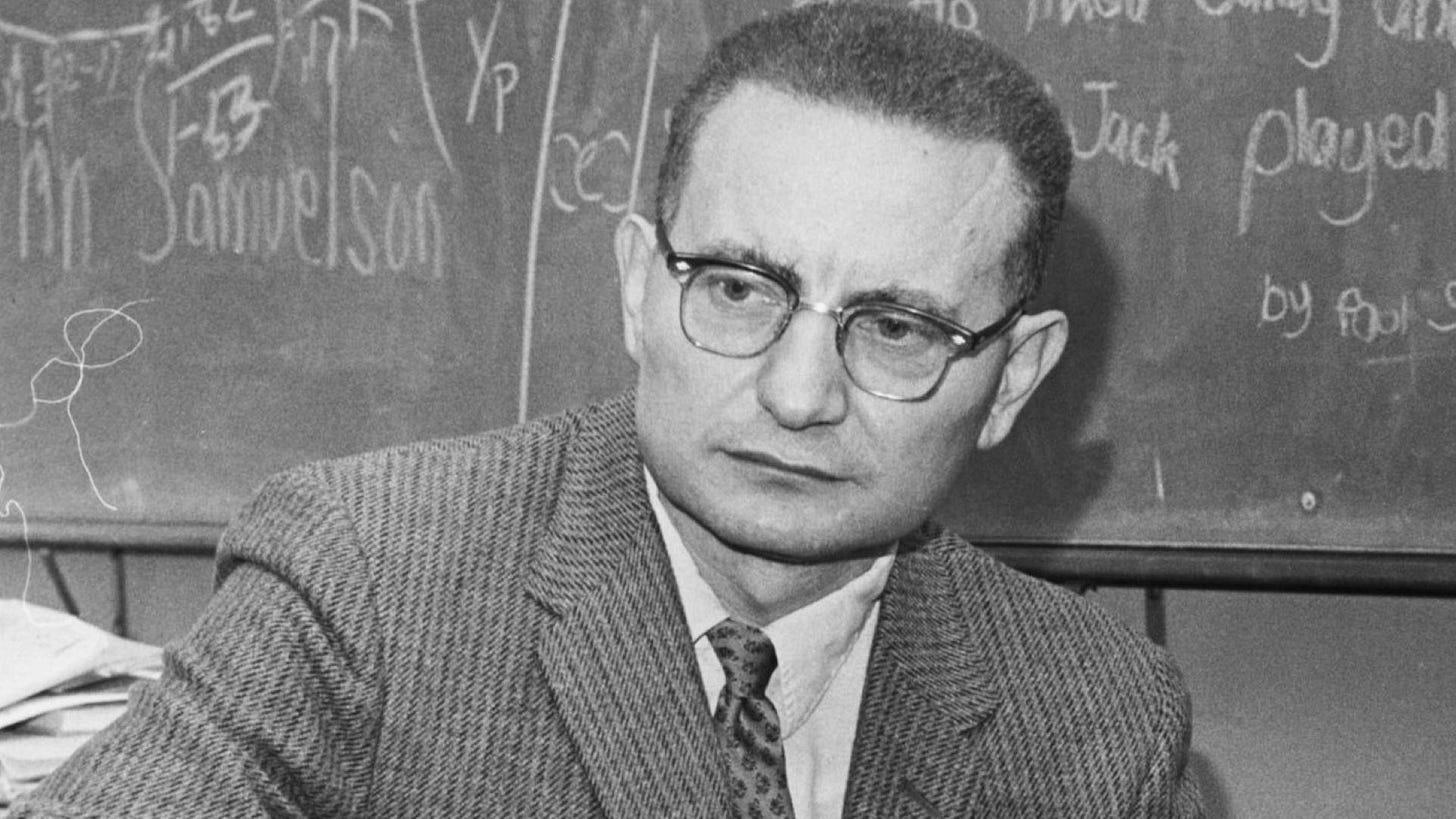

3️⃣ A dividend quote

Paul Samuelson was an important American economist.

In 1970, he became the first American to win the Nobel Prize in Economic Sciences.

Dividend investors should pay attention to his advice.

You can earn large returns by patiently allowing your investments and income to grow.

“Investing should be more like watching paint dry or watching grass grow. If you want excitement, take $800 and go to Las Vegas” - Paul Samuelson

4️⃣ Dividends do better in drawdowns

Dividend stocks outperform the market in recessions.

This study looked at the S&P 500 Dividend Aristocrat Index and the S&P 500 Index.

It found that the Dividend Aristocrat Index outperformed the S&P by 6.5% each year during the recessions and recoveries in 2000 and 2008.

Click on the image to go to the study.

5️⃣ Example of a dividend stock

We’ve shared some advice from Warren Buffett, now let’s look at one of his stocks.

Chubb Limited sells insurance policies to individuals and businesses.

They have raised the dividend for 31 years in a row!

Profit Margin: 18.2%

Forward PE: 13.2x

Dividend Yield: 1.2%

Payout Ratio: 14.6%

That’s it for today

In case you missed it:

Used sources

Interactive Brokers: Portfolio data and executing all transactions

Finchat: Financial data

Should there be a fifth explicit group of "cannibal" stocks or is that an inherent part of the other four groups?