My Dividend Investing Philosophy

Welcome to Compounding Dividends!

If you’re going to spend your valuable time reading this, it’s important to understand My Dividend Investing Philosophy.

Let’s teach you what you need to know about dividend investing.

⭐ Big announcement ⭐

Next Saturday (12 October), we have a big announcement to make.

Starting then, Compounding Dividends will evolve into a full investment platform.

Stay tuned and make sure you don’t miss out.

Most people invest for retirement

Someday you’ll want to stop working, but you’ll still need to pay your bills.

To successfully invest for retirement, you need to:

Replace your job income

Make sure you don’t run out of money

Grow your income at least as fast as inflation

If these are your goals, a great investing strategy should:

Grow your wealth reliably for a long time

Minimize the volatility of your portfolio so you sleep well

Avoid behavioral investment mistakes

Be easy to understand and follow

Get paid a reliable stream of dividends

Let’s explore how Dividend Growth Investing can help with each of these.

Grow your wealth reliably

For a company to keep raising its dividend payments, it must also grow its earnings steadily.

When a company’s earnings and dividends go up, its stock price usually rises too.

Companies that grow their dividends often do better than the market.

Minimize volatility

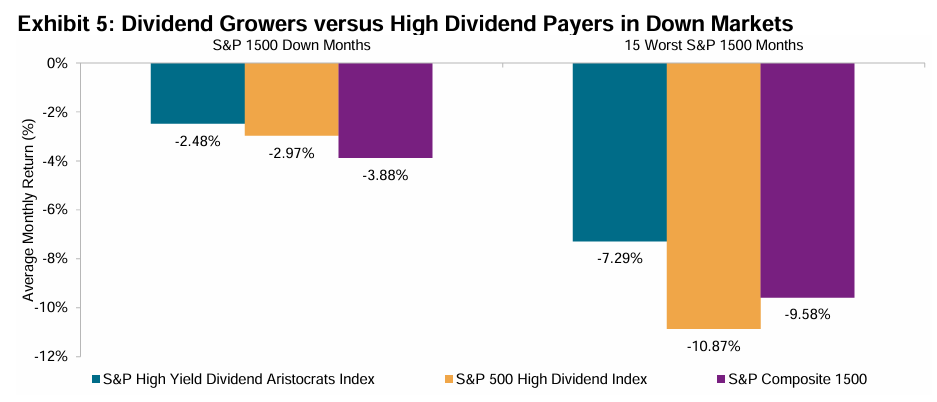

Dividend growers tend to fall less than the market during drawdowns and bear markets.

The image shows that companies with strong dividend growth fall less than high-yield dividend stocks and the index.

The three bars on the left show performance during months when the market is down.

The three bars on the right show performance during the worst 15 months in history.

This is very important.

Most investors underperform the market due to behavioral errors.

They often panic and sell when the market drops.

Generate income

Dividends can generate a lot of income over time.

If you invested $10,000 in J.P. Morgan 20 years ago and reinvested your dividends, you would have the following:

More than $89,000

An 11.5% average annual return

More than $2,000 in annual dividend income

You would have already collected more in dividends than your original investment!

Keep up with inflation

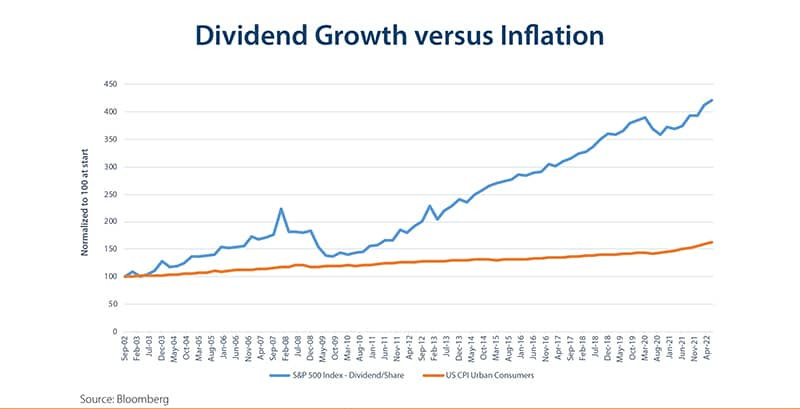

Companies with growing dividends can give you steady, increasing income.

This helps protect you from inflation during retirement when you depend on your dividends.

The image shows how dividends from the S&P 500 grow compared to the CPI, which measures inflation.

Easy to understand

Dividend Growth Investing is simple.

Dividends are just a way for a company to share its profits with people who own its stock.

We want to invest in companies that steadily grow their earnings and dividends over time.

These companies can deliver great results in the long run!

That’s why Dividend Growth Investing is the core of our strategy.

We can improve it with two things:

Buyback yield

In-depth research

Add buybacks for more gains

When a company purchases its own shares, it’s called a stock buyback.

This reduces the total number of shares meaning the remaining shares represent a bigger part of the company.

If you own a business that earns $10 per share and the company buys back 50% of its outstanding shares, EPS will increase from $10 to $20. As a result, the stock price should also double.

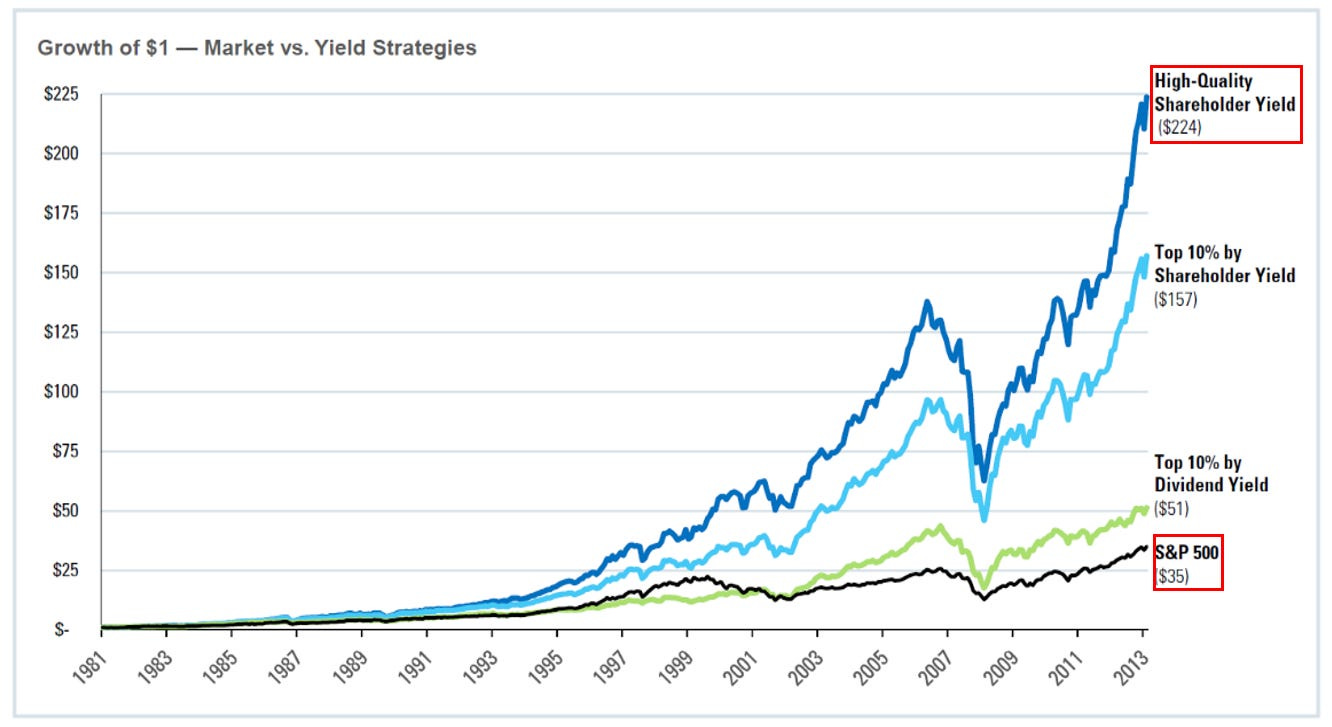

The chart below shows the return you’d get from different levels of buybacks.

Here are some more advantages of buybacks:

Buybacks increase your ownership of the company, so buybacks give you the same outcome as reinvestment

Buybacks are tax efficient - you increase your ownership without paying taxes on the dividend

Insiders are doing the buying for you - good management will only buy when shares are undervalued

Your dividends will grow as your ownership increases.

You can earn income from companies that don’t pay a dividend by selling shares.

“Periodic stock dividends are the practical equivalent of cash - readily saleable by those who want money rather than stock.” - Benjamin Graham

Shareholder yield

Shareholder yield is the combination of the dividend yield and the buyback yield.

What’s interesting?

Shareholder yield performs even better than dividends alone!

Investing = Ownership

As long-term investors, we don’t think about buying stocks, we think about buying businesses.

“When we own portions of outstanding businesses with outstanding managements, our favorite holding period is forever.” - Warren Buffett

When you buy a dividend-paying company, it’s the same as buying a local business.

Imagine buying the best car wash in your town as a retirement investment.

The business is already doing well. You would likely:

Hire a good manager to handle daily operations

Check in occasionally to see how things are going

Take some profits regularly for your living expenses

That’s what dividend investing is all about!

The best part?

Since you’re focused on cash flow, you can ignore market prices. When you’re not looking to sell, prices don’t matter.

You just relax and cash your checks while the business earns you money.

Deep Research

Most dividend investors only look at the dividend.

They use it as a shortcut to evaluate the business.

But successfully investing in dividend stocks is way more than that.

Here’s why I always look deeper:

Boeing grew their dividend from 2014 to 2019 at a rate of more than 23% a year:

Source: Finchat

But their revenue and operating income declined:

Source: Finchat

They financed their dividends by growing their debt:

Source: Finchat

How I analyze stocks

I use a 10-point framework to analyze dividend stocks.

Do I understand the business model?

Is management capable?

Has the company grown the dividend attractively in the past?

Is the company active in an attractive end market?

What are the main risks for the company?

Does the company have a healthy balance sheet?

Is the company a great capital allocator?

How does the past and future growth of the company look?

Can the company grow dividends into the future?

Does the company trade at a fair valuation level?

I also take a broad approach.

Focusing on shareholder yield, not just dividend yield.

I use lists like the Dividend Champions and Achievers rather than the Aristocrats, which are limited to the S&P.

There are excellent businesses everywhere, so I look globally.

Conclusion

I believe in investing in real companies that make real profits.

I’m looking to buy:

Businesses I can understand

With competitive advantages

Run by great management

At fair prices

Then hold them for the long term.

It’s a powerful, simple, and easy-to-understand strategy.

Here’s what it offers:

Excellent returns

Protection during downturns

An income stream that grows faster than inflation

Adding shareholder yield keeps all the benefits of dividend investing while adding:

Tax efficiency

More capital growth

Another way to receive capital from companies

Faster compounding from reinvesting dividends + buybacks

If that sounds interesting to you, follow along, and let’s compound our dividends together!

That’s it for today

In case you missed it:

Used sources

Interactive Brokers: Portfolio data and executing all transactions

Finchat: Financial data