💸 The Power of Dividend Growth

Every Wednesday it’s Dividend Day.

In this series, I will teach you 5 things about dividend investing in less than 5 minutes.

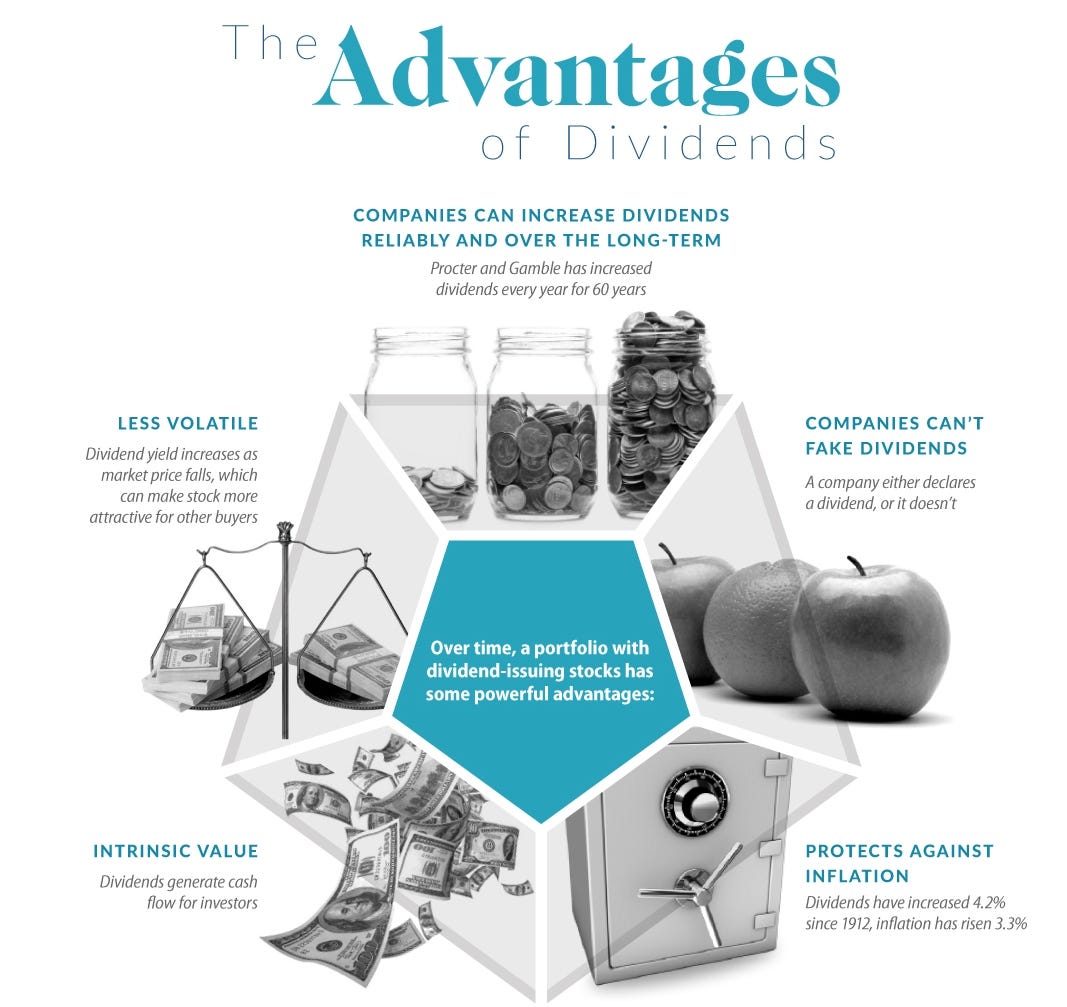

1️⃣ Dividends Have Great Benefits

Companies that keep raising their dividends are good investments.

Here are some reasons to invest in these companies:

2️⃣ A record payout

Last year, companies paid over $1.66 trillion in dividends!

This year, they are expected to pay even more.

It’s the power of compounding put to work.

3️⃣ A dividend quote

Legendary investor Warren Buffett was taught by value investor Benjamin Graham.

Benjamin Graham recognized the power of growing dividends:

“The prime purpose of a business corporation is to pay dividends regularly and, presumably, to increase the rate as time goes on.” - Benjamin Graham

On Saturday, we’ll tell you more about the advantages of buying companies that regularly increase their dividends.

4️⃣ The power of dividend growth

An S&P Global report shows that companies with growing dividends are:

Strong and careful with their money

Steady in tough markets

Less likely to cut dividends during bad times

Better long-term investments than high-yield stocks that don’t grow

Click the image to get the PDF.

5️⃣ Example of a dividend stock

One company that helped set the 2023 dividend record?

Microsoft.

You probably know Microsoft. If not, they make money from cloud services, software, and hardware.

They also earn from ads on Bing, LinkedIn, and subscriptions like Microsoft 365 and Xbox Game Pass.

Microsoft has been growing its dividend by about 10% a year. Last year, they paid almost $22 billion in dividends!

Profit Margin: 36%

Forward PE: 31.6x

Dividend Yield: 0.72%

Payout Ratio: 25.3%

Source: Finchat

That’s it for today

That’s it for today.

🙏 Compounding Dividends is a new project. We would LOVE to get your feedback on this. Like this post, reply to this email or leave a comment on this post to help us take Compounding Dividends to the next level 🙏

In case you missed it:

Used sources

Interactive Brokers: Portfolio data and executing all transactions

Finchat: Financial data

Instead of paying dividends (which are taxed), Terry Smith and I prefer companies invest those retained earning in project with the highest ROCE

Would love to see the list of dividend growth stocks that would get the ‘buy’ label today, also covering the non-US markets. Thanks for considering.