💸 Berkshire’s Most Valuable Assets

Every Wednesday it’s Dividend Day.

In this series, I will teach you 5 things about dividend investing in less than 5 minutes.

1️⃣ Berkshire’s most valuable assets

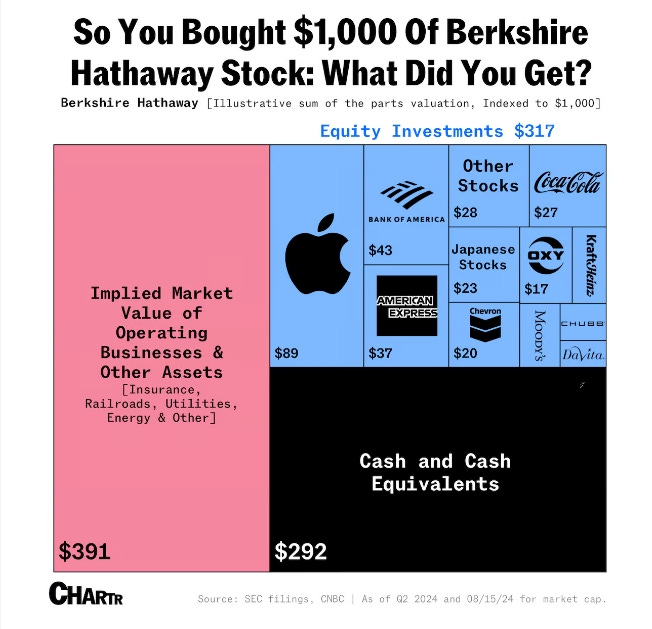

Investors tend to see Berkshire Hathaway just as Warren Buffett’s stock portfolio.

But the companies Berkshire fully owns are more valuable than its stock investments.

These include:

GEICO: Auto insurance

BNSF Railway: Freight transportation

Berkshire Hathaway Energy: Power generation and distribution

2️⃣ Where Berkshire gets its cash

Berkshire Hathaway’s public portfolio is invested in energy, financials, and consumer companies.

Its private businesses are mainly in financials, utilities, and energy.

The chart below shows the dividend yields in these sectors.

Berkshire tends to own companies that create a lot of cash flow and pay high dividends.

On Saturday, we’ll dive deeper into Berkshire’s fully owned companies.

3️⃣ A dividend quote

I loved reading Rockefellers’ autobiography recently.

You know what John Rockefeller loved?

Dividends!

“Do you know the only thing that gives me pleasure? It’s to see my dividends come in.” - John D. Rockefeller

4️⃣ Dividends - A New Perspective

Washington Trust Bank did a study on dividend investing.

They built a portfolio of high-yield, low-volatility stocks.

This strategy provided higher income and better risk-adjusted returns than the S&P 500.

The image compares the dividend income from their strategy to the S&P 500.

Click on the picture to access the full PDF.

5️⃣ Example of a dividend stock

Let’s look at a stock from the high-yielding energy sector.

Chevron has paid dividends for more than 30 consecutive years.

They make money by finding and producing oil and natural gas.

Chevron also refines these resources into gasoline, diesel, and other products, and they invest in renewable energy projects for the future.

Profit Margin: 11%

Forward PE: 11.1x

Dividend Yield: 4.5%

Payout Ratio: 62.1%

Source: Finchat

That’s it for today

🙏 Compounding Dividends is a new project. We would LOVE to get your feedback on this. Like this post, reply to this email or leave a comment on this post to help us take Compounding Dividends to the next level 🙏

In case you missed it:

Used sources

Interactive Brokers: Portfolio data and executing all transactions

Finchat: Financial data

The link to the PDF also did not work for me. Maybe we have to be logged into Washington Trust's website? 🤷

Berkshire Hathaway is a spectacular dividend paying company. The dividends are automatically reinvested into the company. Berkshire takes care of everything for you. You don't need to bother with taxes, ex-div date, payment dates, etc. The only way you'd see it is the rising pile of cash if you look inside or the rising stock price if you only look at the outside. 😉

Lots of folks talk about Schwab's Dividend Fund, ticker symbol $SCHD. They really ought to be talking about a different ticker symbol ... namely, $BRK.B!

The PDF link does not work.

Can you please send me the study mentioned?

Thanks. Mark