8 Benefits of Dividend Growth Investing

Dividend Growth Investing is amazing.

It has plenty of advantages for you as an investor.

Let’s teach you everything you need to know today.

We’ve covered the basics of dividend investing here.

As a reminder, there are 2 main types of dividend investing:

High-Yield Dividend Investing

Dividend Growth Investing

High-Yield Dividend Stocks

High-yield dividend investors want companies that pay bigger dividends than usual.

They focus on earning income in the short to medium term.

Here are some examples of high-yield companies:

Methode Electronics

Methode Electronics designs and manufactures electronic parts and components like sensors, switches, and connectors.

Dividend Yield: 5.4%

5-Year Dividend Growth: 4.9%

Source: Finchat

CNA Financial

CNA Financial is an insurance company that offers property and casualty insurance to both businesses and individuals.

Dividend Yield: 7.3%

5-Year Dividend Growth: 4.2%

Source: Finchat

Dividend Growth Stocks

Dividend growth investors look for companies that regularly increase their dividend payments each year.

They aim to earn money from both the growing dividends and the rising share price.

Dividends might start small but grow bigger over time.

Here are some examples:

Home Depot

Home Depot is a home improvement store that sells building materials, tools, and gardening supplies to homeowners, contractors, and builders.

Dividend Yield: 2.5%

5-Year Dividend Growth: 11.6%

Source: Finchat

Visa

Visa is a payment company. It makes money by charging fees to stores and banks when people use Visa credit and debit cards.

Dividend Yield: 0.74%

5-Year Dividend Growth: 15.8%

Source: Finchat

Steady dividend growth can lead to great returns over time.

That’s why we focus on Dividend Growth Investing at Compounding Dividends.

Here are 8 benefits of this strategy

1️⃣ The magic of compounding

Reinvesting your dividends helps your money grow faster.

When your dividends are increasing, the growth is even more powerful.

The image shows the returns for these cases:

Not reinvesting dividends

Reinvesting dividends with no growth

Reinvesting dividends that grow at 4% each year

2️⃣ Income Growth

Dividend growth investing can provide a steady, increasing income.

This growth helps protect you from inflation during retirement when you depend on your dividends.

The image shows how dividends from the S&P 500 grow compared to the CPI, which measures inflation.

3️⃣ Lower volatility

Dividend growers tend to fall less than the market during drawdowns and bear markets.

The image shows that companies with strong dividend growth fall less than high-yield dividend stocks and the index.

The bars on the left show performance during months when the market is down. The bars on the right show performance during the worst 15 months in history.

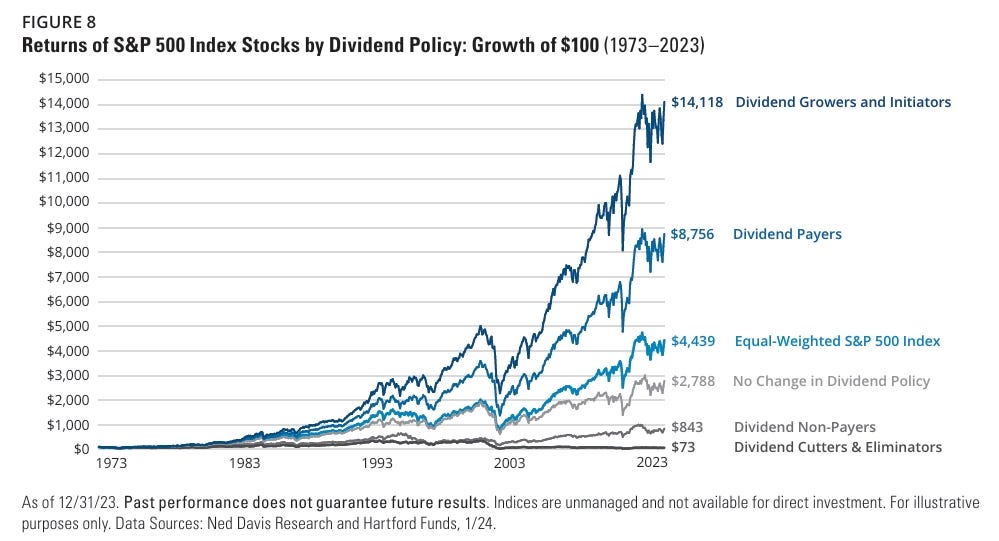

4️⃣ High Total Returns

For a company to keep raising its dividend payments, it must also grow its earnings steadily.

As earnings and dividends grow, the share price usually increases too.

That’s why companies that grow their dividends often do better than the market.

5️⃣ Dividend Growth Indicates Quality

Consistent dividend growth depends on strong financial health and a reliable business model.

A company that keeps raising its dividends has made enough profit to cover costs and boost payouts regularly—no easy task!

Dividend Kings have raised their dividends for 50 years (!). There are only 54 of them.

Here are a few examples:

6️⃣ Flexibility

A dividend growth strategy is flexible.

It allows you to reinvest your dividends to compound over time and build a Dividend Income Machine.

When you need money—like in retirement or for unexpected expenses—you can take your dividends as cash.

Dividend Growth Investing can give you a lot of income over time!

7️⃣ Dividend Growth Investing: A Long-Term Approach

Dividend Growth Investing is a long-term strategy.

It lets you hold investments long enough to benefit from compounding.

To see how powerful compounding can be, check out Warren Buffett’s net worth by age:

Long-term strategies also let you ride out market volatility.

In the long run, stocks always go up:

8️⃣ Behavioral Benefits

Regular dividend payments give you returns regardless of the stock price.

Dividend growers usually drop less during market declines. This helps dividend investors stay calm and avoid panic selling during market dips.

Poor behavior often causes average investors to underperform the market.

Conclusion

A dividend growth strategy has many benefits:

It uses compounding to create a steady income that can outpace inflation.

It tends to be less volatile and offers strong total returns.

It focuses on profitable companies with solid financial health.

Overall, it’s a great way to build wealth over time.

That’s it for today

🙏 Compounding Dividends is a new project. We would LOVE to get your feedback on this. Like this post, reply to this email or leave a comment on this post to help us take Compounding Dividends to the next level 🙏

In case you missed it:

Used sources

Interactive Brokers: Portfolio data and executing all transactions

Finchat: Financial data

I'd be very hesitant about Methode Electronics ($MEI). 🤔

The dividend record has been impressive. Seeking Alpha shows a steadily growing dividend ever since 1990. 📈

However, past financials are lumpy. Net income experienced a surge from 2015 only to collapse this past year. Free Cash Flow is just as lumpy too. Total returns for the past 10 years with dividends reinvested is -69.60%. It looks like the company has a new CEO in place and they are on a journey to transform the business. I would encourage everyone to visit the company's website and check out the latest earnings presentation. Maybe we will see a new Methode Electronics in a few years? 🤷

T. Rowe Price ($TROW) has been in funk for a while so the dividend yield is nice. The company is cash rich with steady revenues and decent cash flows. The dividend is very secure. 💪

Chevron ($CVX) suffers from the cyclical hydrocarbon boom and bust cycle (especially when weather and politics put their thumbs on the scale!) but is an essential player in the energy space. Debt levels are manageable. This is another dividend that is very secure. 💪

Unfortunately, these companies are not ones that will make you rich. They will help keep you rich in the long run though. 💰 Add a few companies like Reality Income ($O) and United Parcel Service ($UPS), a couple of bonds for stability, and cash in a money market account to get you through a rainy day and you will be just fine with your income fund. You can add some juice to your portfolio with one or two closed end funds like Reaves Utility Income Trust ($UTG) or BlackRock Utilities, Infrastructure, & Power Opportunities Trust ($BUI). 🧃

Nice article as always