Why Buffett Loves - But Won’t Pay -Dividends

Warren Buffett built an empire without paying dividends. Yet, he thrives on collecting them. Here's how:

Warren Buffett is the greatest investor of all time. Over nearly six decades, he turned Berkshire Hathaway from a failing textile mill into a trillion-dollar empire.

He’s compounded money at a rate no one else has matched.

And he’s only ever paid one dividend.

That’s right. If you own Berkshire Hathaway, you’ve probably never received a cent in dividends. Buffett refuses to pay them. Instead, he reinvests every dollar of profit into acquiring more businesses, buying more stocks, or repurchasing shares.

This strategy has made his investors richer than they ever could have imagined. In Buffett’s own words from this year’s shareholder letter:

Yet, here’s the paradox.

Buffett doesn’t invest that way himself.

The vast majority of his biggest holdings - Apple, Coca-Cola, American Express, Chevron - are dividend-paying stocks.

He loves collecting dividends from the companies Berkshire owns.

Here’s what he said about Coca-Cola in his 2022 letter:

“The cash dividend we received from Coke in 1994 was $75 million. By 2022, the dividend had increased to $704 million. Growth occurred every year, just as certain as birthdays. All Charlie and I were required to do was cash Coke’s quarterly dividend checks. We expect that those checks are highly likely to grow.”

And there’s more.

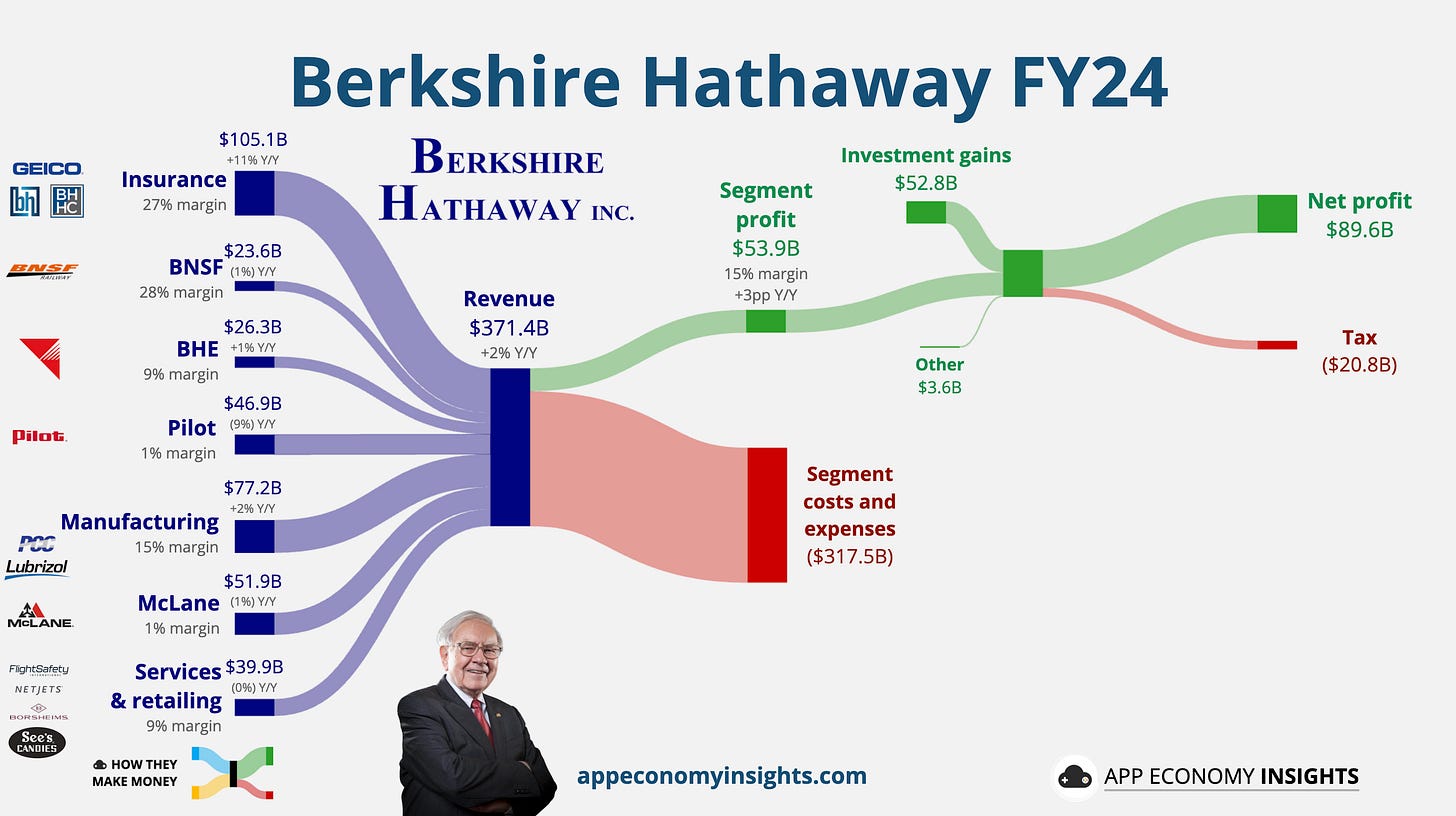

Buffett instructs Berkshire’s operating companies - like GEICO, BNSF Railway, and Dairy Queen - to send all excess cash back to headquarters. He’s essentially demanding dividends from his own businesses while refusing to give them to shareholders.

“We like the companies in which we have investments to pay to us the money they can’t use efficiently in their own business," - Warren Buffett

Those businesses are cash machines. If you want to learn more about them, you can read our article here.

Look at what Buffett said later in this year’s shareholder letter:

Foregoing dividends. Given the way Buffett invests, I think that word choice is intentional.

Buffett is saying that Berkshire shareholders are making a sacrifice by not receiving dividends. Here’s how the dictionary defines ‘forego’:

So what’s really going on here?

The Magic of Internal Compounding

Buffett understands something most investors don’t: capital allocation is everything. When a company pays a dividend, that money leaves the business forever. The investor can reinvest it, but the company itself loses that capital.

Paying a divided is the right choice for businesses like GEICO, Bank of America, and BNSF that generate more cash than they can productively reinvest.

But Buffett has always believed that he can do a better job compounding money inside Berkshire than his shareholders can do on their own.

And history proves him right.

Most investors don’t beat the S&P 500 - but Buffett has destroyed it.

If Berkshire had started paying a dividend decades ago, it wouldn’t be the powerhouse it is today.

Why Buffett Loves Dividend Payers (But Not Paying Them)

So why does Buffett love owning dividend-paying stocks? Simple: he treats them like bond coupons.

Coca-Cola, Bank of America, Apple, and Chevron send Berkshire billions of dollars every year.

Buffett collects these cash flows and then does what only he can do - find the best ways to reinvest them.

He takes dividends from the world’s best businesses and reallocating them into even better opportunities. It’s a perpetual money machine.

To be fair, Buffett does return capital to shareholders - he just prefers to do it through buybacks when he think Berkshire Hathaway’s stock is undervalued.

The Ultimate Capital Allocator

It turns out that Buffett does pay himself dividends - just not in the traditional sense.

Every dollar his subsidiaries send to Berkshire is a dividend. But instead of passing them on to shareholders, he reinvests them and outperforms the market.

This is why Buffett doesn’t want Berkshire paying a dividend. It’s also why he loves companies that do. He’s playing the game at a higher level than anyone else.

If you want to build wealth like Buffett, think like a capital allocator.

Invest in companies that reinvest wisely, then share what’s left with shareholders.

And if you find a company that does it as well as Berkshire Hathaway, never sell it.

That’s how you truly get rich.

Used sources

Interactive Brokers: Portfolio data and executing all transactions

Finchat: Financial data