Berkshire's Cash Machine

Berkshire Hathaway started as a small textile mill in the 1830s.

Warren Buffett turned it into one of the largest holding companies in the world.

Let’s teach you everything you need to know about Berkshire’s cash machine.

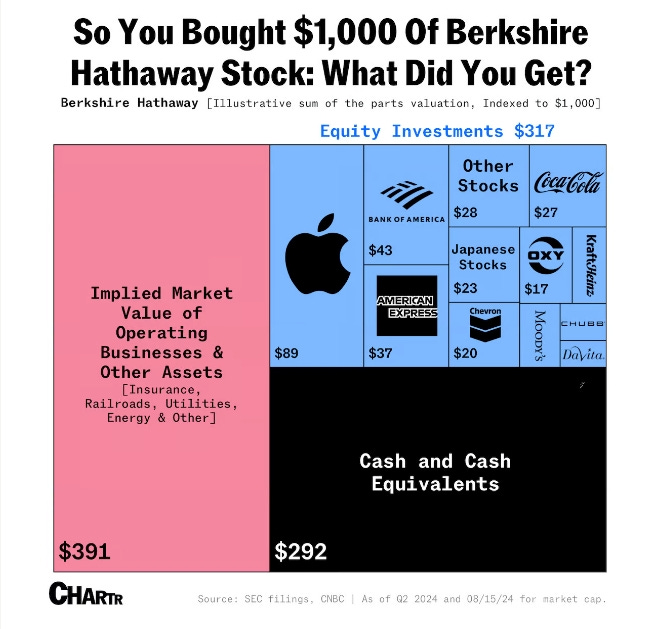

Buffett’s stock picks like Apple, Coca-Cola, and Chevron get a lot of attention.

But the companies Berkshire fully owns are worth even more!

Let's explore Berkshire’s private businesses and learn how you can build your own cash machine like Buffett.

We’ve already talked about Buffett’s stock holdings.

One thing they have in common is that they pay Berkshire a lot in dividends.

The privately held portfolio of Businesses at Berkshire is no different.

Some of the biggest pieces of the privately held portfolio are:

BNSF Railway - one of the largest rail networks in the US

GEICO - one of the largest auto insurers in the US

Berkshire Hathaway Energy - various energy businesses, including utilities and renewable energy

Dairy Queen - fast food restaurant known for ice cream and hamburgers

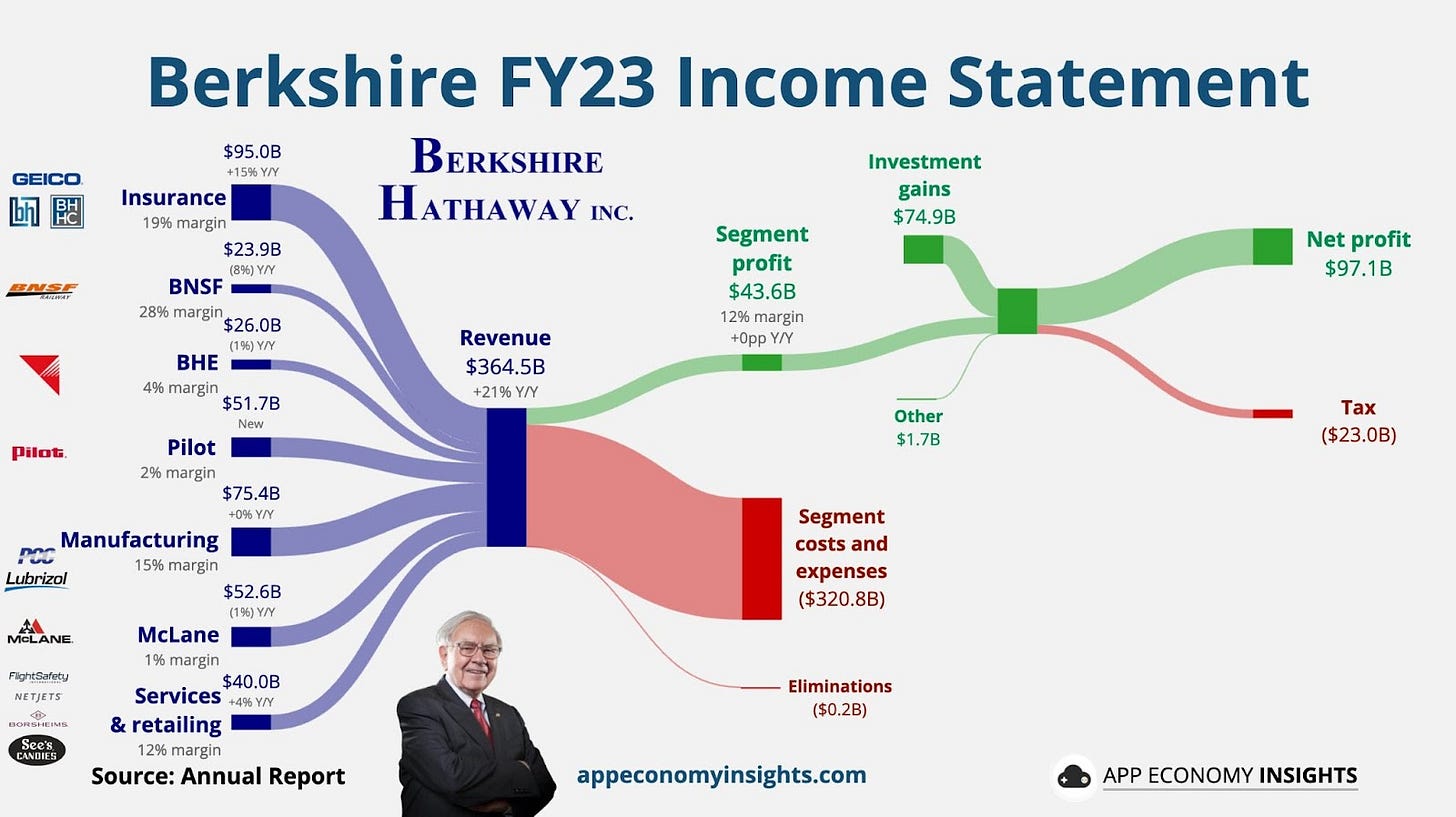

Here’s a look at Berkshire’s income statement.

The privately owned companies brought in over $360 billion (!) in revenue last year.

Berkshire’s private businesses are mostly in the financial, utilities, and energy sectors.

Like its public investments, these companies generate a lot of cash flow and pay high dividends.

“We like the companies in which we have investments to pay to us the money they can’t use efficiently in their own business," - Warren Buffett

You may not be able to buy an entire insurance company or railroad like Buffett, but you can study the types of businesses he buys and use them as inspiration in your portfolio.

Market Sectors

The image shows the 11 sectors of the S&P.

The amount each sector pays in dividends can vary a lot.

The financial, utilities, and energy sectors, where Berkshire’s private businesses are, tend to have higher dividend yields.

Dividend investors can use this as a guide for finding interesting companies.

If you prefer a passive approach, you can invest in ETFs that track these sectors.

Here’s a simple breakdown of the sectors Berkshire invests in, some notable companies, and the largest ETF for each one.

Energy

The energy sector includes all companies that operate in the oil, gas, and consumable fuels businesses.

These could be companies that drill for oil and gas, transport and refine fuel, or companies that sell and distribute fuel to consumers.

Major examples: Exxon Mobil Corp. (XOM), Chevron Corp. (CVX), ConocoPhillips (COP)

Largest energy sector ETF: Energy Select Sector SPDR ETF (XLE)

Financials

The financial sector includes companies involved in investing, finance, and the movement and storage of money.

Financial sector industries include insurance, credit services, asset management, and banks.

Major examples: Berkshire Hathaway Inc. (BRK.A, BRK.B), JPMorgan Chase & Co. (JPM), Visa Inc. (V)

Largest financial sector ETF: Financial Select Sector SPDR ETF (XLF)

Utilities

The utility sector is made up of companies that produce and distribute electricity, water, and gas.

In addition, many utility companies are developing and integrating renewable energy sources.

Major examples: NextEra Energy Inc. (NEE), Southern Co. (SO), Duke Energy Corp. (DUK)

Largest utilities sector ETF: Utilities Select Sector SPDR ETF (XLU)

Some Example Companies

When you’re looking for investing ideas, you can look at the holdings of the ETFs that track the sectors with good dividend yields.

Here are the holdings of XLF, the ETF tracking the Financials sector:

Source: Finchat

From there, you can look into the holdings and see which ones look most interesting.

Here’s the data on the largest holding from each of the 3 sectors highlighted above.

Financials

🏦 JPMorgan Chase & Co.

How does the company make money?

JPMorgan makes money by providing banking services like loans and credit.

They also earn from investment banking activities, such as helping companies raise money and managing investments for clients.

Why is it an interesting dividend stock?

Current dividend yield: 2.2%

Payout ratio: 24.5%

2-Year Forward Dividend Growth: 12.4%

2–Year Forward Revenue Growth: 2.6%

Source: Finchat

Energy

🛢️ Exxon Mobil

How does the company make money?

Exxon Mobil makes money by finding and producing oil and natural gas.

Exxon also refines these resources into gasoline, diesel, and other products, and they invest in renewable energy projects for the future.

Why is it an interesting dividend stock?

Current dividend yield: 3.2%

Payout ratio: 45%

2-Year Forward Dividend Growth: 4.3%

2–Year Forward Revenue Growth: 1.3%

Utilities

🔌 NextEra Energy

How does the company make money?

NextEra Energy makes money by generating and selling electricity from renewable sources like wind and solar power.

They also operate traditional energy plants and provide utility services, charging customers for their electricity use.

Why is it an interesting dividend stock?

Current dividend yield: 2.4%

Payout ratio: 63.6%

2-Year Forward Dividend Growth: 10%

2–Year Forward Revenue Growth: 3.3%

Source: Finchat

Conclusion

Warren Buffett likes companies that make a lot of cash in both his public and private businesses.

Even though you can’t buy an entire railroad or power company, you can still learn a lot from his style:

Look in sectors or industries that pay above-average dividends.

Find strong, stable companies in those sectors.

Compound the dividends they send you

Over time you can build your own version of Berkshire Hathaway's cash-generating machine!

That’s it for today

🙏 Compounding Dividends is a new project. We would LOVE to get your feedback on this. Like this post, reply to this email or leave a comment on this post to help us take Compounding Dividends to the next level 🙏

In case you missed it:

Used sources

Interactive Brokers: Portfolio data and executing all transactions

Finchat: Financial data