💸 Your $500 Dividend Plan

Every Wednesday it’s Dividend Day.

In this series, I will teach you 5 things about dividend investing in less than 5 minutes.

1️⃣ High Yield = High Income

High yields can generate a lot of income.

In the image, you can see how much you need to invest to get $500 a year in dividends.

So when you want to receive $500 in McDonald’s dividends, you should invest $22,485.

Source: Money Morning

2️⃣ High-Yield ETF

ETFs can be interesting as you are immediately well-diversified.

Just take the Invesco High Yield Equity Dividend Achievers ETF (ticker: PEY) for example.

PEY holds 50 companies that are paying an attractive dividend. The ETF has a dividend yield of 5.1%.

Holdings include among others Altria, and Verizon.

Source: Finchat

3️⃣ A dividend quote

When you invest in a company, you become the owner of this business.

Dividends are the payments you receive from your companies:

"The very attention we place on rising dividends puts us squarely in the position of 'owners' of a company, of true investors who understand that a satisfying and reasonable return from a stock investment isn't a gift of the market or luck or the consequence of listening to some market maven, but it is the logical and inevitable result of investing in a company that is actually doing well enough, in the real world, to both pay dividends and to increase them regularly". - Lowell Miller

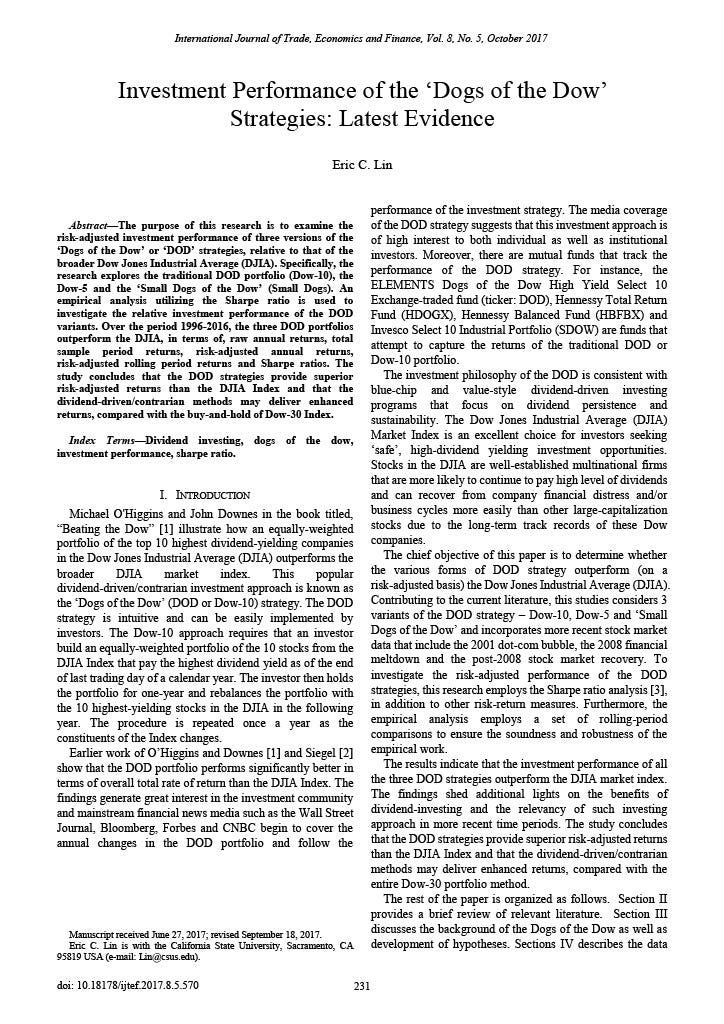

4️⃣ A High Yield Strategy

The Dogs of the Dow is a simple strategy to create a portfolio of companies with high dividend yields.

In Saturday’s article, you’ll learn all about it.

For now, here’s some interesting research on how it has performed in the past:

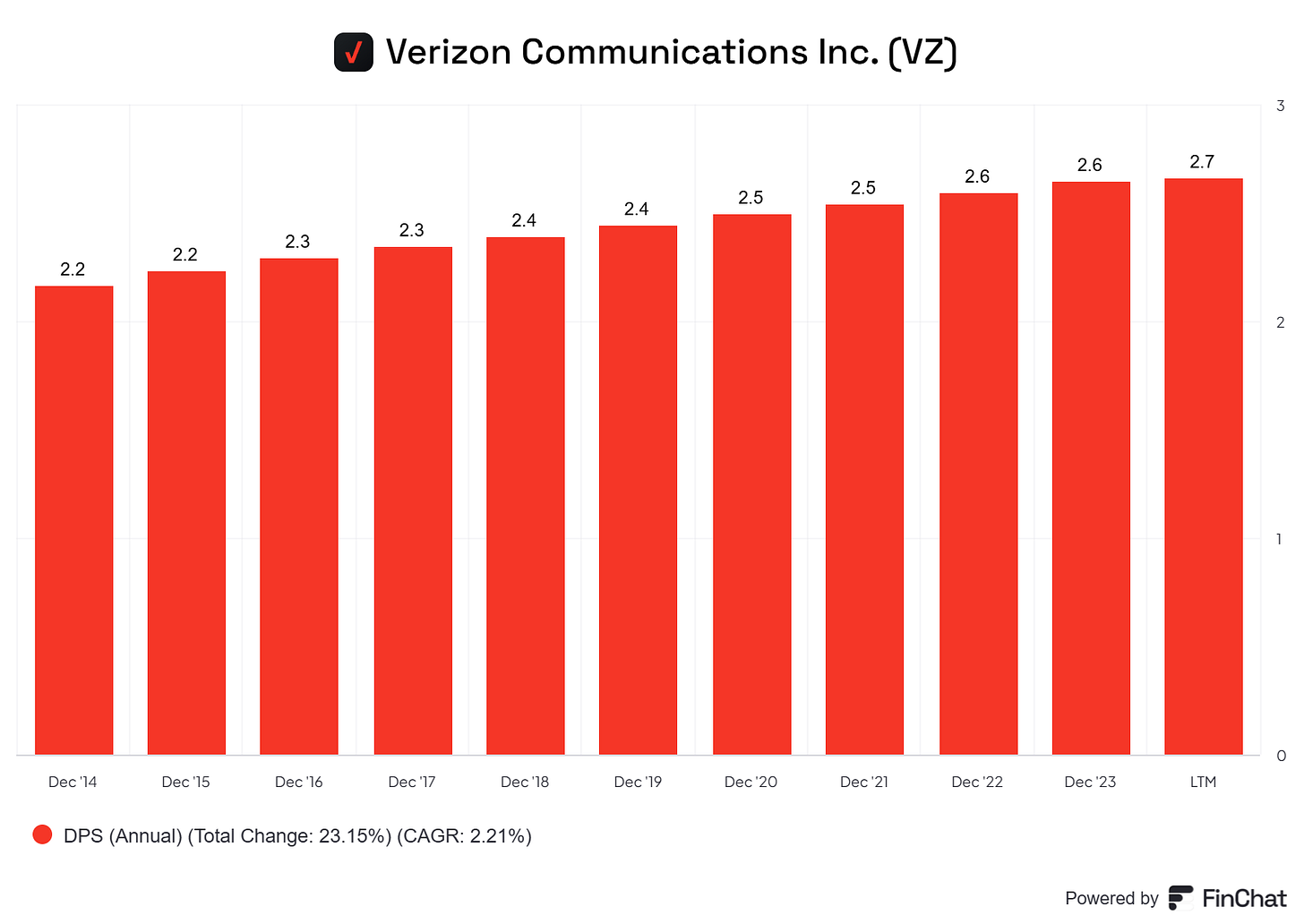

5️⃣ Example of a dividend stock

Verizon makes money by providing phone, internet, and TV services to customers. They earn from monthly subscriptions and selling devices like smartphones and tablets.

Verizon has increased its dividend for 17 consecutive years.

An investment of $10,000 gives you a dividend of $650 per year.

Here are some of the key fundamentals:

Profit Margin: 8.4%

Forward PE: 8.9x

Dividend Yield: 6.5%

Payout Ratio: 99.6%

Source: Finchat

That’s it for today

Look out for our next article where you’ll learn everything you need to know about the Dogs of the Dow.

In case you missed it:

Used sources

Interactive Brokers: Portfolio data and executing all transactions

Finchat: Financial data

Good thoughts. Though, I personally never loved the idea of Dividend investing. Most dividend companies tend to move sideways over long periods of time. That 8% dividend they give out ends up being no different than just investing in a market index over time.

I am familiar with the "Dogs of the Dow" but find two potential faults with it.

First, the investable universe is rather small. There are many high quality small and mid cap companies with spectacular finances that are not in the Dow. I always mention REITs and BDCs and none of these are present in the index.

Second, rebalancing will most likely create a taxable event. The article mentions that even taking taxes into account the DOD approach will still do well. Everyone's taxes are very unique though. I would be careful here. Maybe an ETF or some other kind of fun would be better to own.

On the positive side, the approach is super simple, isn't it? And if something is simple then it becomes doable and repeatable. That can enable a lot of people who would otherwise be turned off from investing.