💸 6 Attractive Income ETFs

ETFs worth considering

Today is Dividend Day.

In this series, I will teach you 5 things about dividend investing in less than 5 minutes.

1️⃣ Stock A or Stock B?

It's important to understand the balance between Starting Yield and Dividend Growth.

The higher yield brings in more cash at first, but the lower yield can catch up over time.

Both options have their benefits - knowing your goals and timeline will help you choose the best one for your portfolio.

Stock A

3% Yield

10% Growth rate

Stock B

7% Yield

3% Growth rate

2️⃣ Income ETFs

The image shows the dividend income you would receive from $100,000 invested in these 6 ETFs:

QQQ (Invesco QQQ Trust): Yield of 0.63%

VOO (Vanguard S&P 500 ETF): Yield of 1.29%

SCHD (Schwab U.S. Dividend Equity ETF): Yield of 3.46%

JEPI (JPMorgan Equity Premium Income ETF): Yield of 7.20%

JEPQ (JPMorgan Nasdaq Equity Premium Income ETF): Yield of 9.56%

QYLD (Global X NASDAQ 100 Covered Call ETF): Yield of bu 11.61%

The last 3 ETFs - JEPI, JEPQ, and QYLD use options strategies - selling covered calls, to raise the yield.

This increases the income-t may also limit how much the ETF price can grow in rising markets.

It also brings risks from market volatility and potential losses if stock prices fall.

3️⃣ An investing quote

Josh Peters wrote"The Ultimate Dividend Playbook".

He believes in a dividend-focused investment approach, emphasizing the importance of investing in companies with sustainable and growing dividends.

"Dividends may not be the only path for an individual investor's success, but if there's a better one, I have yet to find it" - Josh Peters

4️⃣ Dividend Aristocrats

State Street Advisors wrote a paper on their strategy for investing in the Dividend Aristocrats.

They argue that a long term track record of paying regular cash dividends indicates quality because to do so, a company must:

Generate top line earnings

Effectively manage existing operations

Invest prudently in future growth.

Click the image showing the dividend income from the Dividend Aristocrats versus the S&P 500 to read the whole paper:

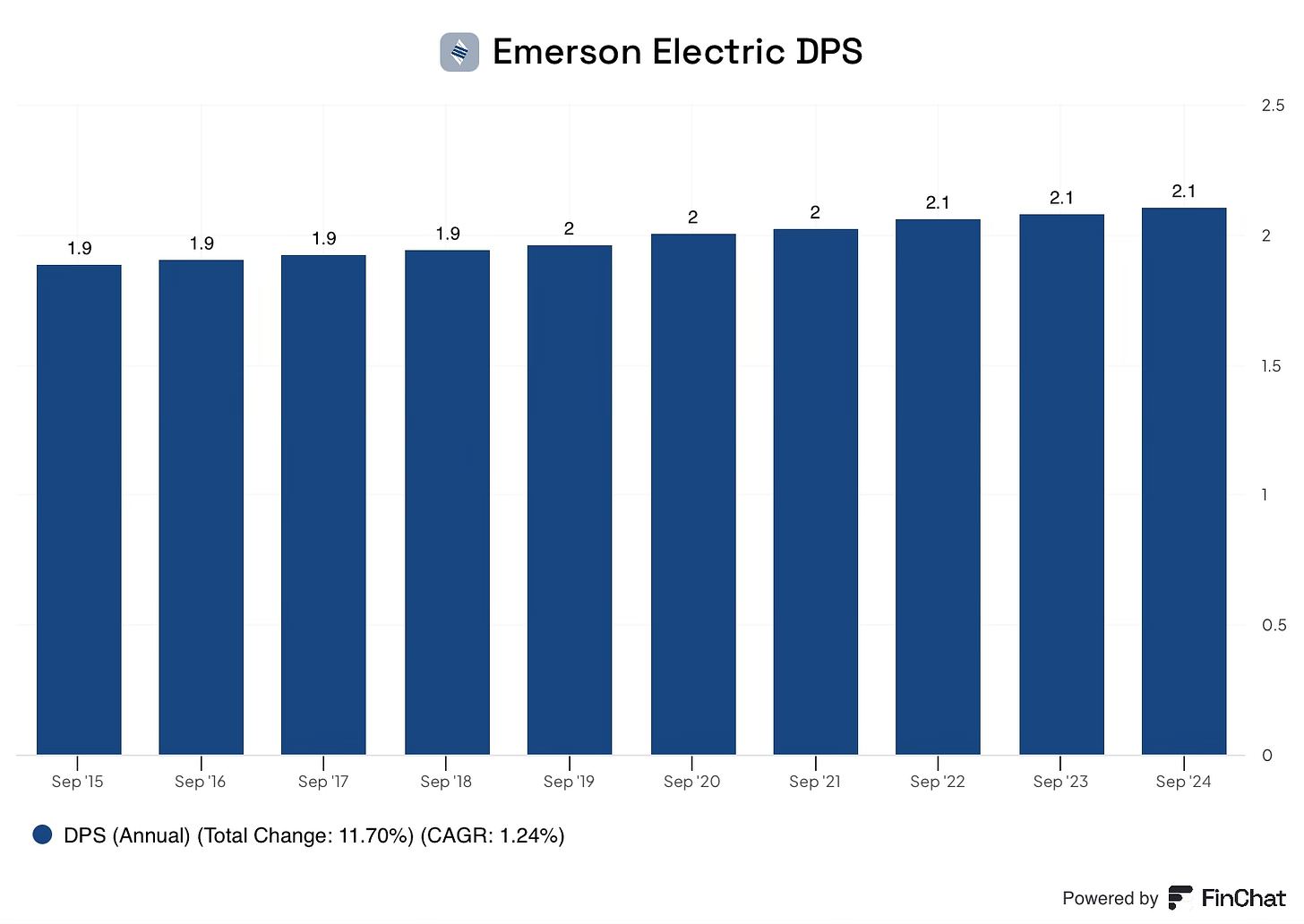

5️⃣ Example of a dividend stock

Emerson Electric is a Dividend Aristocrat.

They make industrial automation equipment and software that helps businesses and factories operate more efficiently.

Profit Margin: 11.3%

Forward PE: 22.5x

Dividend Yield: 1.6%

Payout Ratio: 74.1%

Source: Finchat

That’s it for today

In case you missed it:

Used sources

Interactive Brokers: Portfolio data and executing all transactions

Finchat: Financial data